In today’s regulatory landscape, a robust company KYC process is essential for onboarding customers smoothly. These critical steps enable businesses to establish secure and transparent relationships with their corporate clients by collecting, verifying, and analyzing company information. By adhering to regulatory standards and mitigating transaction risks, organizations can safeguard their operations and reputation. This article delves into the significance of company KYC onboarding, the intricacies of the process, and potential solutions to address associated challenges.

Understanding Company KYC Onboarding

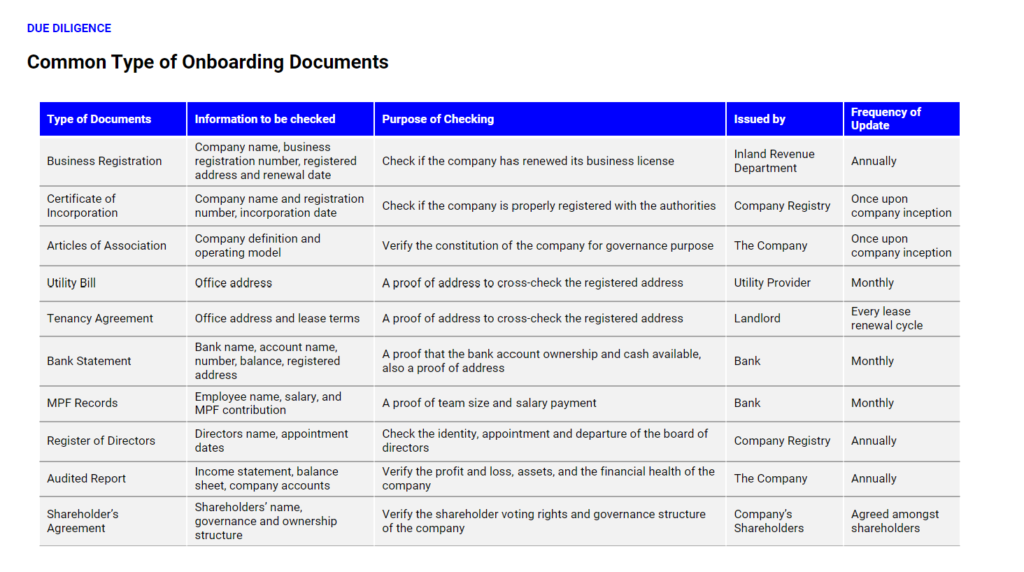

Company KYC onboarding refers to the process of collecting and verifying company information to establish its identity, assess risk, and grant access to an organization’s services. One of the most labor-intensive processes is document due diligence. For example, when a financial institution onboards a corporate client, many documents are collected as part of KYC. The following section will highlight the common type of documents collected and elaborate on their objectives, issuing party, key information checked.

Document Type:

- Business Registration:

- Information to be verified: Company name, business registration number, registered address, and renewal date.

- Purpose: Check if the company has renewed its business license.

- Issued by: Inland Revenue Department.

- Frequency of Update: Annually.

- Certificate of Incorporation:

- Information to be verified: Company name, registration number, and incorporation date.

- Purpose: Check if the company is properly registered with the authorities.

- Issued by: Company Registry.

- Frequency of Update: Once, upon company inception.

- Articles of Association:

- Information to be verified: Company definition and operating model.

- Purpose: Verify the constitution of the company for governance purposes.

- Issued by: The Company.

- Frequency of Update: Once, upon company inception.

- Utility Bill:

- Information to be verified: Office address.

- Purpose: A proof of address to cross-check the registered address.

- Issued by: Utility Provider.

- Frequency of Update: Monthly.

- Tenancy Agreement:

- Information to be verified: Office address and lease terms.

- Purpose: A proof of address to cross-check the registered address.

- Issued by: Landlord.

- Frequency of Update: Every lease renewal cycle.

- Bank Statement:

- Information to be verified: Bank name, account name, account number, balance, registered address.

- Purpose: A proof of bank account ownership, available cash, and address.

- Issued by: Bank.

- Frequency of Update: Monthly.

- MPF (Mandatory Provident Fund) Records:

- Information to be verified: Employee name, salary, and MPF contribution.

- Purpose: A proof of team size and salary payments.

- Issued by: Bank.

- Frequency of Update: Monthly.

- Register of Directors:

- Information to be verified: Directors’ names and appointment dates.

- Purpose: Check the identity, appointment, and departure of the board of directors.

- Issued by: Company Registry.

- Frequency of Update: Annually.

- Audited Report:

- Information to be verified: Income statement, balance sheet, company accounts.

- Purpose: Verify the profit and loss, assets, and financial health of the company.

- Issued by: The Company.

- Frequency of Update: Annually.

- Shareholder’s Agreement:

- Information to be verified: Shareholders’ names, governance, and ownership structure.

- Purpose: Verify the shareholder voting rights and governance structure of the company.

- Issued by: Company’s Shareholders.

- Frequency of Update: Agreed amongst shareholders.

An effective KYC onboarding process enables the business to prevent fraudulent activities, comply with regulatory requirements, and evaluate business opportunities and risks effectively.

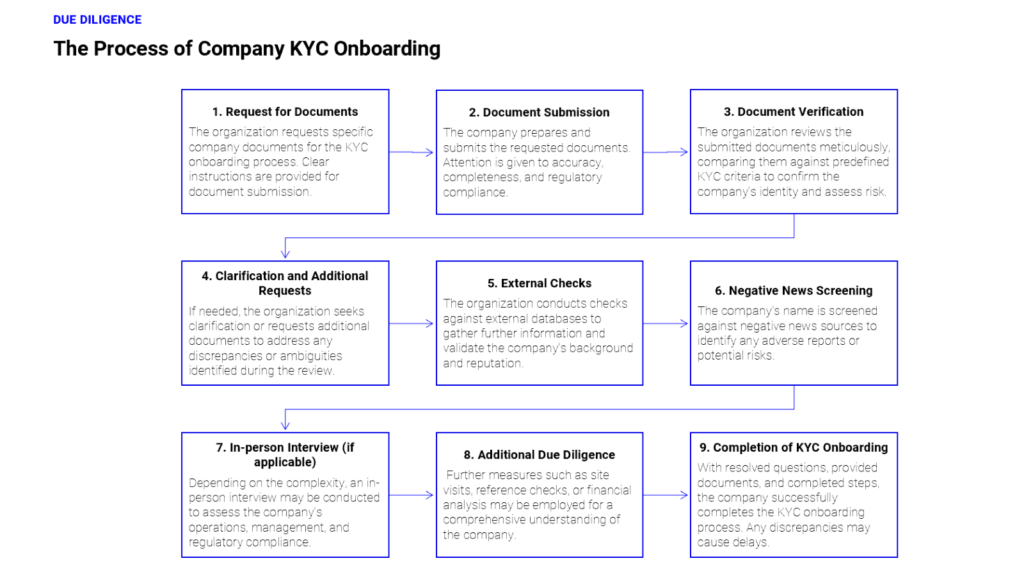

The Process of Company KYC Onboarding

- Request for Documents: The organization initiates the KYC onboarding process by requesting relevant company documents from the company. The organization specifies the required documents for review and provides clear instructions on how to submit them.

- Document Submission: The company prepares the requested documents and submits them to the organization. The company ensures accuracy, completeness, and adherence to regulatory guidelines when providing the documents.

- Document Verification and Assessment: The organization undertakes a meticulous verification process by reviewing the documents submitted by the company. The organization compares the provided documents against predefined company KYC criteria to confirm the company’s identity and assess its risk level.

- Question and Answering: Based on the initial review results and circumstances, the organization may produce clarification questions or request additional documents from the company. This step facilitates the resolution of any ambiguities or discrepancies identified during the document review.

- External Database Check: The organization performs checks against external databases to gather additional information and validate the company’s background and reputation.

- Negative News Screening: The company’s name is screened against negative news sources to identify any adverse reports or potential risks associated with the company.

- In-person Interview: Depending on the nature and complexity of the KYC process, an in-person interview may be conducted to further assess the company’s operations, management, and compliance with regulatory requirements.

- Additional Due Diligence: In some cases, additional due diligence measures such as site visits, reference checks, or financial analysis may be employed to gather a more comprehensive understanding of the company.

- Completion of KYC Onboarding: Once all questions are clarified, documents are provided, and the necessary steps are completed, the company successfully completes the KYC onboarding process. Any shortcomings or discrepancies may result in a delay in the process.

Why is Company KYC Onboarding Important?

Company KYC onboarding serves several vital purposes:

- Compliance: By adhering to regulatory requirements, company KYC onboarding helps organizations mitigate the risk of engaging in illicit activities, ensuring legal compliance and preserving the integrity of their operations.

- Risk Mitigation: Through the verification of company identities and comprehensive risk assessments, businesses can identify and manage potential risks associated with their corporate clients’ activities more effectively.

- Trust and Reputation: Implementing a robust company KYC onboarding process enhances trust between organizations and their corporate clients. By safeguarding the organization’s reputation, it instills confidence in the services provided, fostering long-term and mutually beneficial relationships.

- Eligibility Assessment: Company KYC enables organizations to holistically evaluate business opportunities by weighing risks against potential rewards. This approach facilitates the early detection and rejection of unprofitable clients, minimizing customer dissatisfaction and optimizing resource allocation.

Challenges in Conducting KYC Onboarding

Professionals conducting customer due diligence often encounter the following challenges:

- Manual Errors: Traditional KYC onboarding procedures rely heavily on manual data collection, verification, and analysis, resulting in inefficiencies, human errors, and delays.

- Resource Intensiveness: Manual processes require a significant investment of human resources, including skilled personnel, leading to increased costs for organizations.

- Compliance Challenges: The ever-evolving regulatory landscape poses challenges for organizations to keep pace with changing standards and ensure consistent compliance across their operations.

Solutions

To address the challenges associated with KYC onboarding, organizations can consider the following solutions:

RegTech: Regulatory Technology solutions revolutionize compliance by automating regulations tracking, interpretation, and mappings to relevant processes within organizations. Artificial intelligence and big data also enable seamless data collection, verification, and analysis. When it comes to KYC procedures, RegTech offers end-to-end solutions that automate document verification, data collection, risk assessment, and identity checks. For instance, Digital Identity Verification solutions leverage state-of-the-art technologies such as biometric authentication, document scanning, and data matching to significantly enhance the accuracy and efficiency of identity verification throughout the KYC onboarding process. By automating the verification process, these solutions effectively reduce manual efforts, minimize errors, and ensure strict adherence to regulatory requirements.

Generative AI: Gen AI is beneficial for addressing labor-intensive and time-consuming challenges. With deep learning capabilities, Gen AI excels in analyzing vast amounts of data, identifying complex patterns, and making intelligent decisions. This enables Gen AI to effectively tackle fraud detection and risk assessment, key components of the KYC process. Its ability to process large datasets and recognize subtle anomalies allows it to uncover hidden patterns and flag potential risks that might be missed by traditional methods. Gen AI’s adaptability ensures it can continuously learn from new information and regulatory changes, improving fraud detection accuracy over time. Additionally, its comprehensive risk assessment capabilities, considering various data inputs, empower organizations to make informed decisions and allocate resources effectively. By leveraging Gen AI’s advanced analytics and decision-making capabilities, organizations can streamline KYC onboarding, reduce fraud risk, and ensure regulatory compliance.

Wizpresso AI-Powered Due Diligence Software

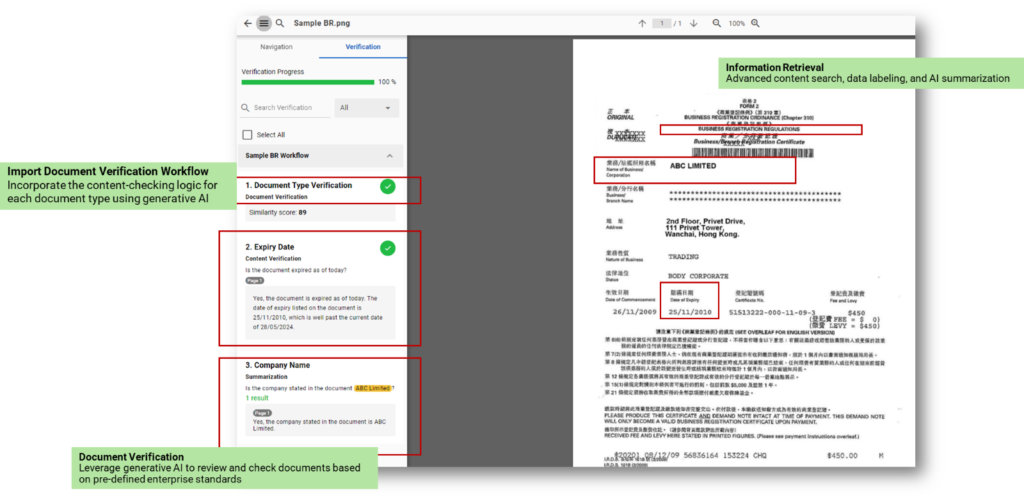

Wizpresso Adnoto is a state-of-the-art due diligence platform underpinned by retrieval augmented generation (RAG) technology. Our solution addresses document review challenges throughout the KYC and onboarding process. Users can seamlessly transfer their KYC onboarding procedures and expertise into an automated workflow using Wizpresso with three simple steps:

- Create a Document Request List: Develop a tailored questionnaire specific to each KYC process, outlining the necessary document requests to gather information from internal and external sources.

- Import Document Verification Workflow: Harness the power of generative AI to incorporate content-checking logic for each document type, ensuring accurate and reliable verification.

- Automate Assessment: Share the questionnaire and automatically review documents obtained from stakeholders to evaluate potential opportunities, streamlining the KYC process and maximizing efficiency.

Examples: Using Wizpresso Adnoto to verify the business registration document when conducting KYC onboarding

For example, users can pre-define a verification workflow or a question list that outlines the necessary information to be checked on a document. Then, Adnoto can automatically extract and verify the information from an uploaded document. While assessing the results, Adnoto will also provide page references and a detailed explanation based on the information checked, further supporting the verification decision, making it traceable, accurate, and reproducible.

Learn more about Adnoto: https://wizpresso.com/KnowledgeManagement/Adnoto

If you wish to learn more about how our platform enables smoother onboarding, contact us at hello@wizpresso.com and tell us more about your use case and needs.