ESG seems complex enough that it should only be for the large MNCs, or listed companies, of Hong Kong: that is indeed far from the truth.

For SMEs and other smaller businesses in Hong Kong, addressing climate change and its impact and integrating ESG principles into their operations is not just a regulatory requirement but a strategic imperative. Climate-conscious practices help mitigate risks, reduce operational costs, and enhance resilience. In addition, long-term financial benefits include cost savings from energy efficiency, waste reduction, and the ability to attract eco-conscious customers and investors.

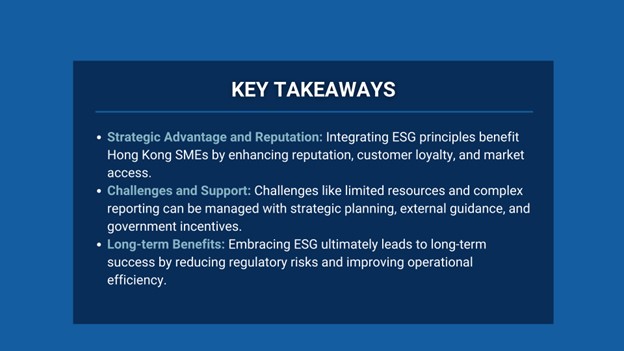

Firstly, meeting ESG targets significantly enhances the market reputation of SMEs. It signals responsibility and forward-thinking, building trust with stakeholders in particular the clients. This improved reputation can lead to increased customer loyalty, better employee retention, and new business opportunities.

The competitive advantages of adopting ESG practices are clear: access to new markets, meeting regulatory demands, and appealing to a growing segment of environmentally and socially conscious consumers.

Despite all the benefits meeting ESG targets bring, SMEs face various unique challenges in integrating ESG targets. Limited resources, lack of expertise, and the complexity of reporting can be significant barriers. Overcoming these requires strategic planning, incremental steps, and possibly external assistance. It is because of this demand that external consultants find themselves a crucial niche, providing the necessary expertise and resources to help SMEs prepare comprehensive ESG reports, identify areas for improvement, and streamline the process overall.

This all goes to show that although the barriers to ESG reporting can be daunting, they are indeed not insurmountable. Starting with simple, incremental steps and leveraging technology can simplify the process: a great first step. Government incentives and peer learning can also support SMEs in their ESG journey. By effectively leveraging ESG reporting, SMEs can gain access to new markets and funding, influencing the investment decisions of stakeholders positively.

Strike a balance: On the one hand, adhering to and striving towards ESG targets give SMEs hope for stability and growth. On the other hand, ignoring ESG targets poses significant risks for SMEs in Hong Kong. These include regulatory penalties, loss of investor confidence, and reputational damage. Furthermore, neglecting ESG practices can lead to missed business opportunities and increased operational risks. Integrating ESG principles into supply chain management can enhance sustainability and resilience, reducing costs and improving efficiency.

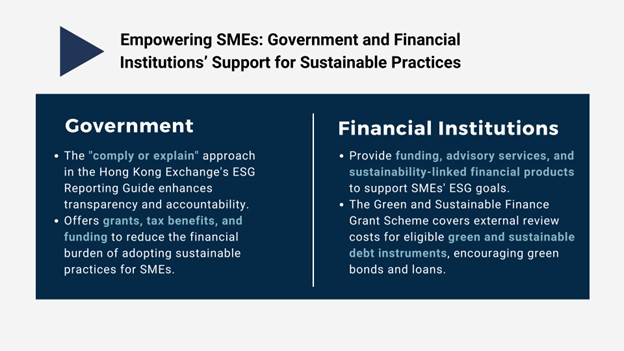

Companies aren’t the only player in this game of ESG: government incentives play a crucial role in encouraging ESG compliance. According to the Hong Kong Exchange’s ESG Reporting Guide, SMEs are encouraged to follow the “comply or explain” approach, which mandates disclosure of ESG information or an explanation for non-disclosure. This regulatory framework aims to enhance transparency and accountability among companies. Additionally, the Hong Kong government offers grants, tax benefits, and funding schemes to support the adoption of sustainable practices, thereby reducing the financial burden on SMEs.

Financial institutions in Hong Kong play a pivotal role in supporting SMEs with ESG goals. They provide funding, advisory services, and sustainability-linked financial products. For instance, the Green and Sustainable Finance Grant Scheme pushed forward by the Hong Kong Monetary Authority provides subsidies to cover external review costs for eligible green and sustainable debt instruments. This scheme is designed to encourage the issuance of green bonds and loans, facilitating the growth of sustainable finance.

Conducting environmental assurance or climate impact audits provide public companies and SMEs with a clear understanding of their environmental impact, areas for improvement, and potential cost savings. These audits help SMEs identify and quantify their climate impact across the supply chain, enhancing sustainability practices.

As mentioned before, specialist consultants play a pivotal role in helping SMEs prepare comprehensive ESG reports. They provide expertise, resources, and guidance, helping SMEs understand regulatory requirements and implement best practices. Climate impact audits, conducted independently, offer an unbiased assessment and actionable insights to enhance sustainability.

In conclusion, for SMEs in Hong Kong, embracing ESG principles is essential for long-term success and resilience. With the right strategies, resources, and support, SMEs can overcome challenges and leverage ESG practices to achieve sustainable growth. Public listed companies, government agencies and NGOs not only should take the lead but should nurture the up-stream, downstream and peers to create the ecosystem of the market. In other words buyers help sellers, at the same time sellers support buyers with readiness and the right tools.