ESG Investing Trends

The practice of investing in companies or funds with sustainable operations and sound governance is not new – however, the emphasis on businesses that are both profitable and making considerable social and environmental impact is gaining more popularity than ever before among institutional investors, according to Morgan Stanley.

Among asset owners surveyed, 80% said they actively integrated sustainable investing in 2019, up ten percentage points from 2017. Factors driving this increase include constituent demand, the perceived potential for attractive financial performance, and evolving regulations that are driving greater disclosure on environmental, social, and governance (ESG) factors.

According to a report conducted by Morgan Stanley, which polled 110 asset owners, including financial institutions, insurers, and pensions in North America, Europe, and Asia Pacific between October and December 2019, eight in ten respondents believe companies with strong ESG practices may make better long-term investments. The majority (57%) envision a time when they will allocate solely to investment managers with a formal ESG approach, though many cite barriers to sustainable investing, including access to adequate tools to measure sustainability goals and quality data.

Here are seven key trends in the adoption of sustainable investing among institutional asset owners:

- Asset owners are increasingly embracing sustainable investing. Most institutional investors envision a time when they will limit allocations solely to investment managers with a formal sustainable investing approach.

- Most investors who practice thematic or impact investing seek to address environmental themes.

- ESG integration is the most common approach to sustainable investing.

- Public equities and fixed income are the asset classes where most institutional investors find quality sustainable investing strategies.

- Nearly half of sustainable investors allocating to fixed income invest in green or sustainability bonds or bond funds.

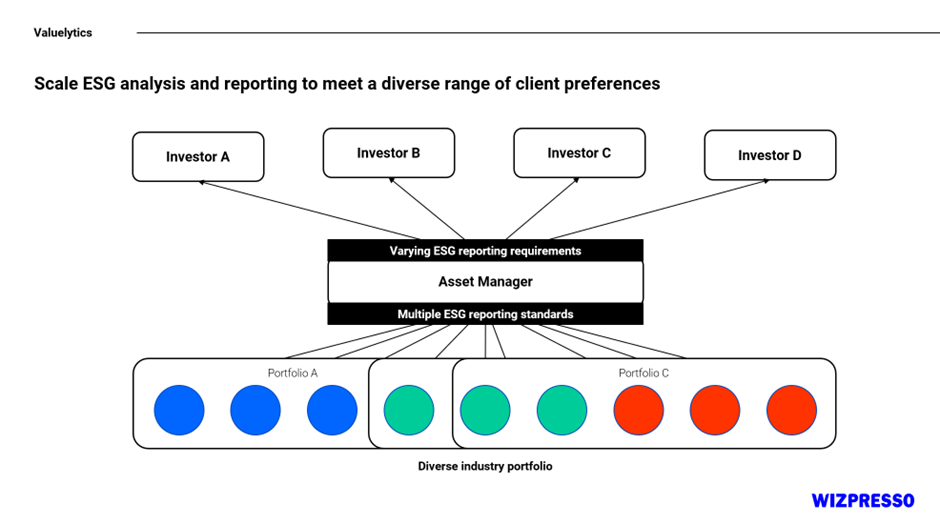

ESG Reporting for Asset Managers

The regulatory landscape specific to asset managers is complex and may include differentiating factors that make ESG reporting unique per industry.

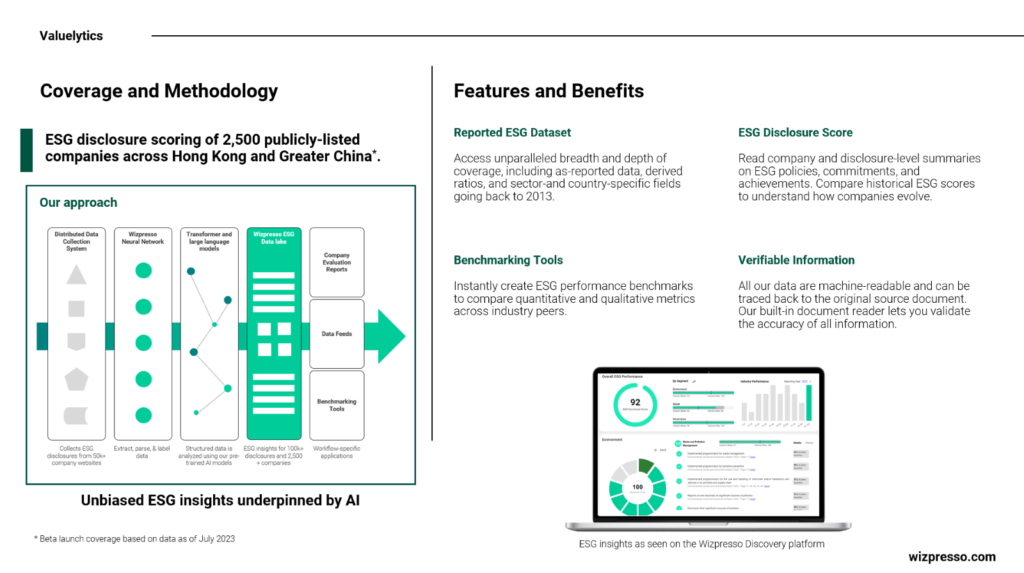

Asset managers face the substantial influence of the TCFD and the SFDR on ESG reporting requirements. The TCFD framework aids organizations in evaluating and disclosing climate-related risks and opportunities, while SFDR seeks to standardize ESG reporting across the EU, creating a dynamic regulatory environment for asset managers to navigate. The requirement to comply with multiple frameworks creates unique challenges that can be resolved with technology. It is essential to select data providers that understand the reporting requirements. For example, Valuelytics offers asset managers a market intelligence platform that analyses companies based on a customizable set of reporting requirements depending on the user’s needs. Our platform empowers asset managers to effortlessly add customized criteria and aggregate key ESG metrics to generate scores for each company in the investment portfolio automatically.

ESG reporting for asset management is very complex. Asset managers must navigate a diverse portfolio of investments, each carrying its own ESG considerations. Additionally, asset managers must align their reporting with their client’s preferences. Recognizing these challenges, Valuelytics leverages generative AI to overcome the analysis of non-standardized ESG disclosures to generate comparable and parsed results.

Learn more about Valuelytics: https://wizpresso.com/MarketIntelligence/Valuelytics