Why IPO and announcement verification needs dedicated tools

IPO prospectuses and listed‑company announcements combine dense legal drafting, complex financials, and strict liability regimes, historically verified with highlighters, Excel, and shared drives over weeks of manual work. AI‑enabled verification tools now structure every statement, connect it to evidence, and centralize collaboration and audit trails, translating into double‑digit percentage time savings and reduced risk of disclosure errors.

For issuers, sponsors, and counsel, the question is no longer whether to digitize verification, but which platform best fits their regulatory context, workflow, and risk appetite.

Leading tools in verification

Leading IPO and disclosure verification platforms now form a clear ecosystem, each covering a different part of the workflow.

1. IPO‑native verification and disclosure governance

Wizpresso Factify is an AI‑powered due diligence and verification platform purpose‑built for IPO prospectuses, annual reports, ESG reports, and regulated disclosures, with deep roots in the Hong Kong and Asian capital markets ecosystem. It automatically boxes up every statement in a prospectus, assigns reference IDs, classifies materiality and statement type, recommends verification scope and priorities, and links statements to supporting evidence across financial statements, legal opinions, and industry reports.

Factify’s automation reduces overall prospectus verification time by around 75%, with preparation steps accelerated by roughly 95%, while integrated completeness checks, compliance Q&A, benchmarking against thousands of listed companies, and audit‑ready workflows help teams manage both speed and regulatory rigor.

Watch: Factify Teaser

2. General document verification platforms

Atticus is widely used by international law firms and issuers in markets like the UK and Australia to manage verification of prospectuses, investor presentations, and other high‑stakes documents through centralized evidence linking and interactive verification notes. These tools focus on manually linking each statement in a public document to supporting sources, generating interactive verification notes, and keeping those notes synchronized with new drafts, delivering roughly 60% time savings per verifiable document in published case studies.

Their strength lies in jurisdiction‑agnostic workflows and broad coverage of regulated documents, making them attractive to corporate issuers seeking a single verification layer across markets.

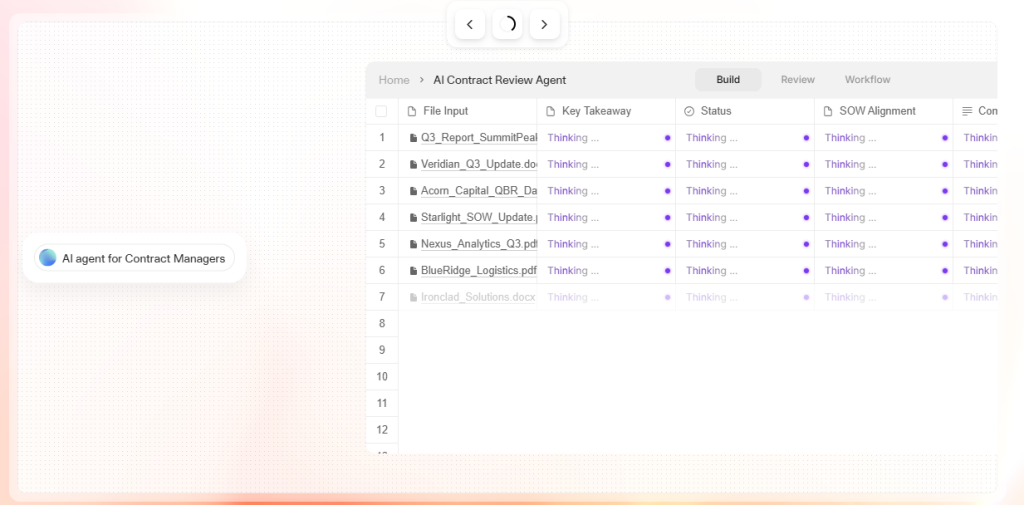

3. Agentic AI

A newer class of tools—AI prospectus analysis agents—targets investment professionals and risk teams rather than lawyers, focusing on extracting key financial data, risks, and legal terms from prospectuses and offering documents with links back to the source text. V7’s AI Prospectus Analysis Agent (including its funding prospectus analysis offering) targets investors and risk teams, extracting key data points, risks, and terms from offering documents to accelerate deal evaluation. These agents help analysts triage deals and standardize review depth, but generally stop short of full legal verification workflows, such as structured verification notes, director sign‑off processes, and listing‑rule completeness checks.

4. Supervisory and in‑house regulator tools

On the regulatory side, supervisors such as CONSOB are piloting AI tools to review prospectuses and disclosure documents for risk indicators and compliance gaps, signalling a broader move toward technology‑enabled verification and oversight across the capital markets lifecycle. Some regulators and supervisory authorities are piloting AI tools to analyze prospectuses and disclosure documents for risk flags, inconsistencies, and compliance issues, mainly to augment review capacity rather than to replace law‑firm verification exercises. While these systems are not commercial tools for market participants, they signal the direction of travel: supervisors increasingly expect issuers and intermediaries to adopt technology‑enabled verification themselves.

Feature comparison across leading verification tools

Legend: ✓ = fully supported; ✕ = not available or not a primary focus; △ = partial / limited or secondary focus.

Key capabilities matrix

How to choose the right verification tool

When selecting an IPO prospectus and announcement verification solution, deal teams should weigh three dimensions: regulatory fit, workflow coverage, and depth of AI automation. IPO‑native platforms like Factify are best suited for sponsors, underwriters, and counsel who need end‑to‑end verification and disclosure governance tightly aligned with local listing rules, while global verification platforms excel for firms seeking a single horizontal layer across multiple markets and document types.

Learn More

- Contact us for a demo session.

- Learn more by visiting the Factify product page.