In an era marked by rapid technological evolution and fluctuating economic landscapes, Hong Kong’s IPO market is at a transformative juncture. Recent reports underscore a newfound optimism after a sluggish first half of 2024, with several factors pointing towards a dynamic resurgence. This revival is being spurred not just by traditional market mechanisms but through a concerted embrace of innovative strategies.

The Current Landscape

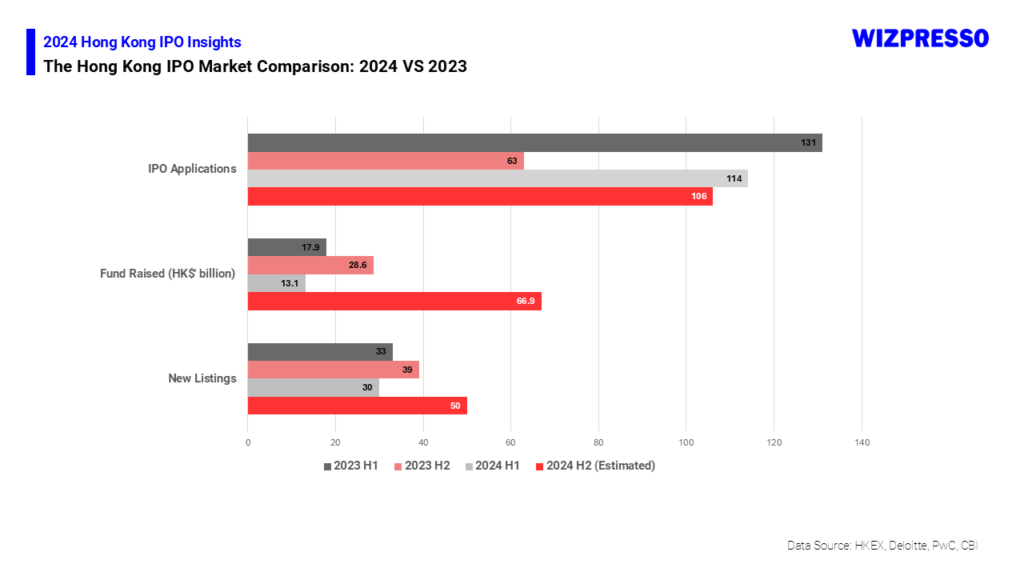

The first half of 2024 witnessed a notable deceleration in IPO activities in Hong Kong. Various reports from the Big 4 highlighted a dip in initial public offerings due to global economic uncertainties and geopolitical tensions.

- Deloitte’s Forecasts: Deloitte expected about 80 new listings for the full year of 2024, raising between HK$60 billion to HK$80 billion. Click Here

- EY’s Insights: According to EY, despite a 20% decline in Mainland China’s IPO volumes, Hong Kong’s IPO market saw a 15% increase in listings and a 10% rise in funds raised in early 2024, with forecasts predicting continued growth due to strong investor interest and favorable conditions. Click Here

- KPMG’s Report: KPMG noted that capital raised from IPOs in Hong Kong reached approximately HK$17.7 billion in the first half of 2024, a noticeable decline compared to previous years. Click Here

- PwC’s Analysis: PwC highlighted that if market sentiment continues to improve, Hong Kong could potentially raise up to HK$70-80 billion in 2024. Market-driven optimizations and tech-centric advancements were cited as key factors for this positive outlook. Click Here

Market Optimism and Recovery

As we move into the second half of 2024, market optimism is gaining momentum. Analysts forecast that the total capital raised by the end of the year could rebound substantially, bolstered by improving market sentiment and investor confidence. This recovery is also attributed to various strategic initiatives aimed at strengthening Hong Kong’s IPO ecosystem.

Tech Industry: A Catalytic Force

Hong Kong’s technological sector is emerging as a pivotal force in this market recovery. The push towards fostering a tech-friendly ecosystem is paying off, with the government and private entities investing heavily in innovation and digital transformation. This commitment is creating a fertile ground for tech-driven IPOs, positioning Hong Kong as a hub for tech enterprises looking to go public.

Furthermore, Hong Kong’s strategic position as a gateway to Mainland China remains a significant advantage. The synergies between Hong Kong’s financial systems and Mainland China’s vast market present unprecedented opportunities for enterprises seeking cross-border capital and market access.

Innovative Strategies Driving the Resurgence

- Increased Support for Tech Startups: The Hong Kong government has rolled out numerous initiatives to support tech startups. By providing grants, tax incentives, and funding opportunities, the government is fostering an environment conducive to innovation and growth. This has resulted in a burgeoning pipeline of tech companies poised for IPOs.

- Transparency and Regulatory Enhancements: Hong Kong Exchanges and Clearing Limited (HKEX) has introduced measures to enhance transparency and streamline regulatory processes. These initiatives are aimed at reducing the time and complexity associated with going public, making the IPO process more attractive and efficient for tech firms.

- Collaborations and Partnerships: There is a growing trend of collaborations between Hong Kong’s financial institutions and global tech companies. These partnerships are facilitating knowledge exchange, driving technological advancements, and creating robust frameworks for IPOs.

- Strategic Initiatives and Capital Influx: With many central banks preparing to lower interest rates, we expect a resurgence of global capital in Asia. Recent discussions between Hong Kong and Middle Eastern partners aim to enhance cross-border investments. As IPO activity increases, Hong Kong is becoming a prime destination for Middle Eastern companies seeking to list, thereby improving market liquidity and valuations, particularly for technology firms under the new Chapter 18C listing regime.

- Sustainable and ESG Investments: The emphasis on Environmental, Social, and Governance (ESG) criteria is also reshaping the IPO landscape. Investors are increasingly favoring companies that demonstrate a strong commitment to sustainable and ethical practices. Hong Kong is leveraging this trend by promoting tech companies that align with ESG principles, thereby attracting a new wave of conscientious investors.

- Blockchain and Fintech: The adoption of blockchain technology is expected to revolutionize trading and settlement processes in the IPO market. Fintech advancements are improving the efficiency and security of financial transactions, making Hong Kong a more attractive destination for global investors.

- Artificial Intelligence: AI is being utilized for investor relations and market analytics, providing deeper insights and fostering transparent communication between companies and investors.

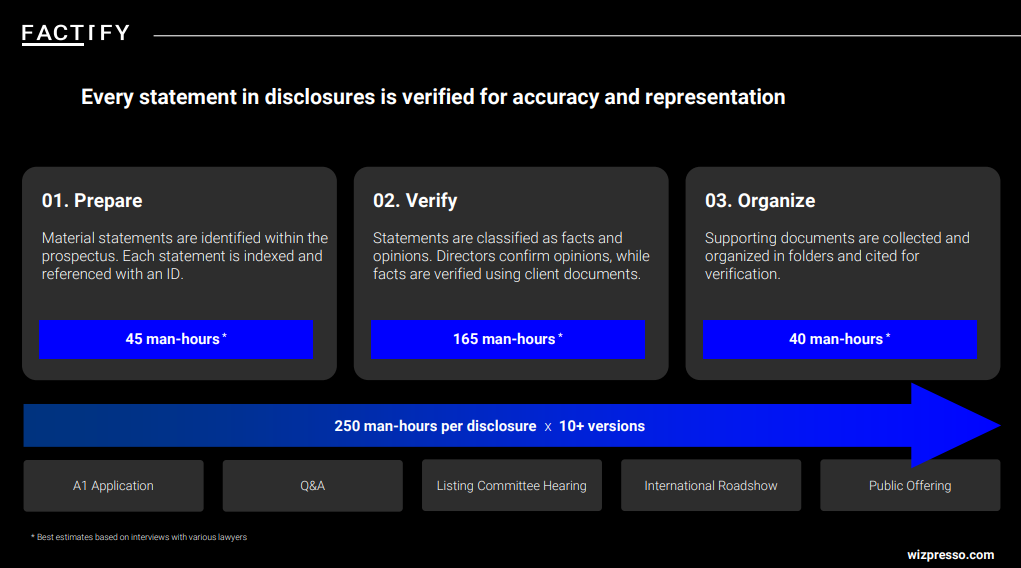

As the landscape evolves, the role of IPO lawyers becomes increasingly critical in navigating the complexities of initial public offerings. Traditionally, the verification process is divided into three main stages, most of which involve manual tasks done by lawyers. This approach can be error-prone and time-consuming, often exceeding 250 hours. As a result, it not only affects accuracy but also places a significant burden on IPO lawyers and impacts the overall interests of sponsors and stakeholders.

Traditional Ways of Verification

Preparation Phase (approximately 45 hours):

- Print out hard copies and highlight each sentence manually.

- Assign a reference ID to each sentence throughout the entire document.

- Compile a spreadsheet detailing reference IDs and document requests.

Verification Phase (approximately 165 hours):

- Determine whether each sentence represents a fact or an opinion.

- Validate each statement with supporting documentation or a signed confirmation statement.

Organize Phase (approximately 40 hours):

- Store certified documents in a secure folder.

- Manually cite and record supporting documents in verification notes.

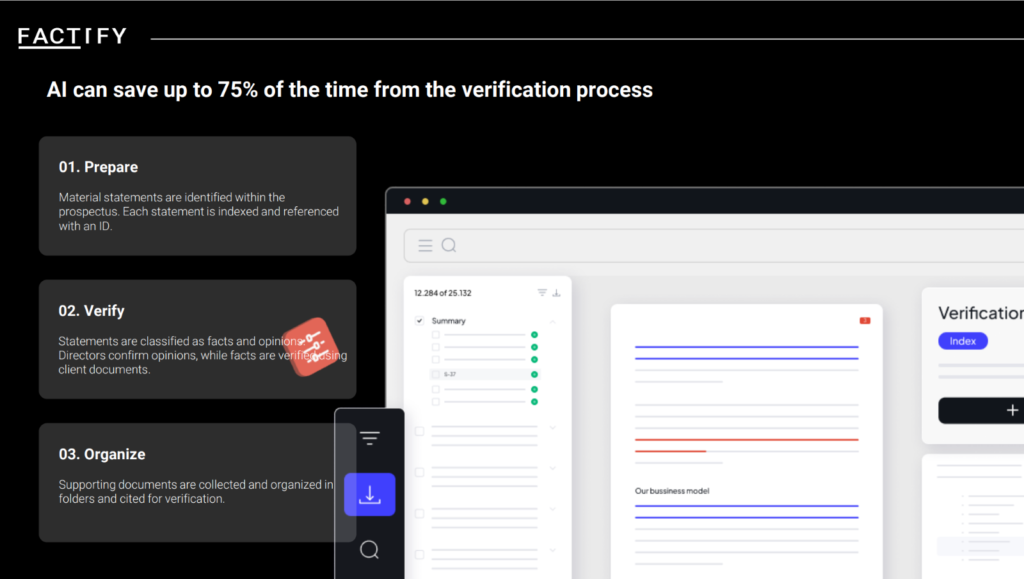

However, leveraging some AI tools can largely address those challenges, streamlining the due diligence workflow and transforming the field of IPO verification by enhancing both efficiency and precision.

Wizpresso’s AI-Powered IPO Due Diligence Software

Wizpresso’s AI-powered IPO due diligence software features several cutting-edge tools designed to revolutionize the work of IPO lawyers, which can save 75% of the time:

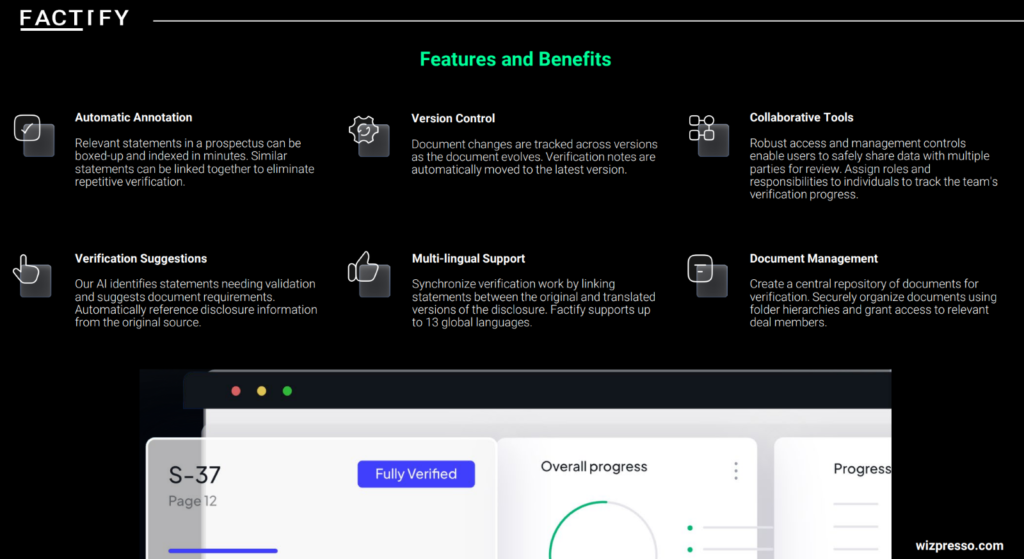

- Automatic Statement Boxing-up, Reference ID Allocation, and Verification Suggestions: Automate the arduous task of organizing and verifying key statements, significantly reducing manual workload while enhancing accuracy.

- AI-powered Version Control and Move Work to the Latest Version: Maintain control over document versions with AI, ensuring that all team members are working with the most current iterations.

- Collaborative Tools to Assign Work and Track Verification Progress in Real-time: Streamline teamwork with tools that allow for the assignment of tasks and real-time tracking of verification progress.

- Integrated Document Management Features to Organize Supporting Documents: Efficiently manage and organize all necessary supporting documents for quick retrieval and review.

- Multi-lingual Support, Enterprise Cybersecurity Measures, and More: Ensure comprehensive support and security with multi-lingual capabilities and top-notch cybersecurity measures.

If you wish to learn more about the solutions, contact hello@wizpresso.com to request a demo.

Conclusion

Looking ahead, the synergy between technological advancements and market reforms is expected to drive unprecedented growth in Hong Kong’s IPO market. The adoption of cutting-edge technologies such as blockchain for trading, AI for due diligence, and big data for market analytics is setting new benchmarks for efficiency and transparency.

Hong Kong’s IPO market is entering a transformative phase, characterized by a blend of innovation and resilience. By capitalizing on its technological advancements and strategic initiatives, Hong Kong is not only poised for a market rebound but is also setting the stage for a tech-driven renaissance in the IPO landscape.