Introducing Thematic Investing

Thematic investing is a top-down investment approach that capitalizes on emerging trends relating to macroeconomics, geopolitics, and technology. These trends encompass long-term, structural shifts arising from innovative business models, disruptive technologies, and changing consumer preferences and behaviors—megatrends that have the potential to change whole industries and shape the way we will live, eat, work, travel, and maintain health in the future.

Thematic investing is intentionally future-looking around specific emerging trends that are expected to evolve over time. The investment process aims to identify companies that may be well-positioned to benefit from these trends and offers an alternative to analyzing companies beyond traditional cycles, location, or industry.

Benefits of Thematic Investing

Our societies and economies are being shaped by powerful global megatrends, from climate change and demographic shifts to technology and energy conservation. These shifts create compelling opportunities.

With the help of artificial intelligence, asset managers can rapidly identify companies relevant to a trend that can provide a number of benefits, including:

- Long-term Growth Potential

- Portfolio Diversification

- Value Alignment

- Investment Transparency

Seismic Trends Shaping Our Future

In recent years, we have seen a convergence of global risks. Natural disasters, job displacement, human conflicts, climate change, resource scarcity, and more all threaten human security. This pressures stakeholders, particularly governments, to prioritize domestic resilience or protectionist measures over sustainability or long-term cooperation. Here are examples of emerging trends we have seen in the 21st century:

- Technological Advancement – New AI and computer processing advancements open endless possibilities in our lives.

- Climate Change – Demand for a sustainable future will advance green technology. 50% of the world’s energy is predicted to come from solar and wind by 2050, up from 7% in 2015.

- Aging Demographics – The aging population, longer life expectancy, and smart living will change biomedical and consumer demands. Some estimates project a 45% increase worldwide in people aged 60 or older by 2030.

How AI and NLP can help asset managers augment fund formulation?

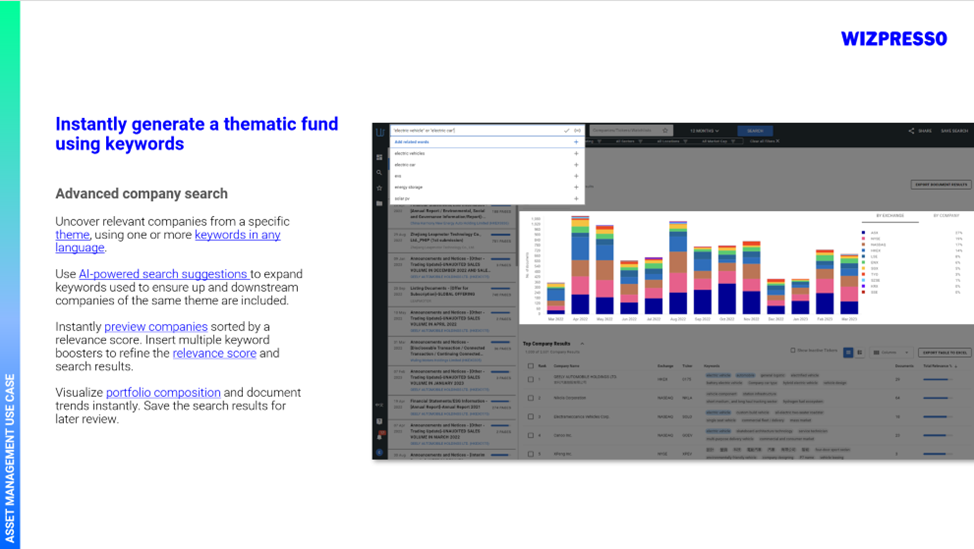

Our platform, Wizpresso Discovery, is a market intelligence software underpinned by natural language processing (NLP) technology. Our AI-powered search enables asset managers to find companies relevant to keywords of a specific theme or topic in seconds.

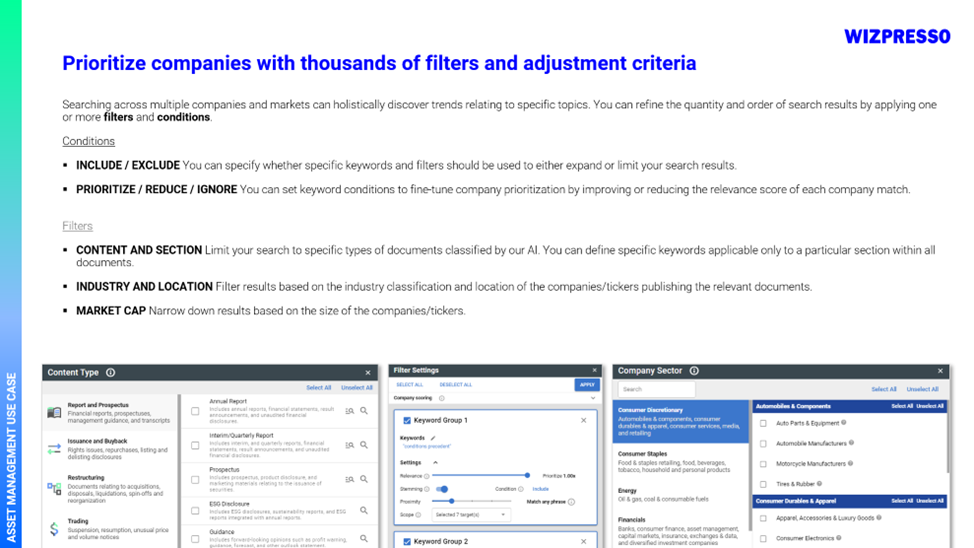

Here are examples of how Wizpresso Discovery can support fund formulation:

- Instantly generate a thematic fund using keywords

- Prioritize companies with thousands of filters and adjustment criteria

- Visualize portfolio composition and document trends instantly

- Receive notifications on new disclosures published by the portfolio

- Monitor emerging keywords by sector or watchlist to generate new ideas

Our platform contains detailed descriptions and metadata about business operations, revenue segments, sectors, locations, and more for over 33,000 publicly listed companies across 13 capital markets. Our model can recommend related keywords for any theme or megatrend you wish to explore. By using Discovery, asset managers can spare time from researching company businesses from annual reports, investor presentations, and company websites.

Learn more about Discovery: https://wizpresso.com/MarketIntelligence/Discovery