IPO verification has become a structural bottleneck in modern capital markets, and the problem starts with the sheer scale and complexity of today’s prospectuses. On average, a listing document can contain well over 10,000 discrete statements and figures presented across narratives, tables, charts, footnotes, and appendices—all of which must be checked, evidenced, and tracked. Human-led review remains critical, but without the right infrastructure, teams are forced into manual, repetitive work that drains time and increases the risk of error. Wizpresso Factify is built to tackle these pain points head‑on by combining AI-native verification with practical workflow tools tailored for IPO teams.

Understanding the verification bottleneck

Traditional verification workflows were not designed for documents with tens of thousands of data points and cross‑references. Each statement needs to be located, interpreted, assessed for materiality, and checked against supporting evidence, often under aggressive transaction timelines. Deal teams are further constrained by version churn, fragmented communication with issuers, and the need to produce a defensible audit trail for regulators and internal committees. The result is a process that can take weeks or months, with much of that time spent hunting for statements, reconciling duplicates, and managing document chaos rather than exercising legal and commercial judgment.

Pain point 1: too many statements, not enough structure

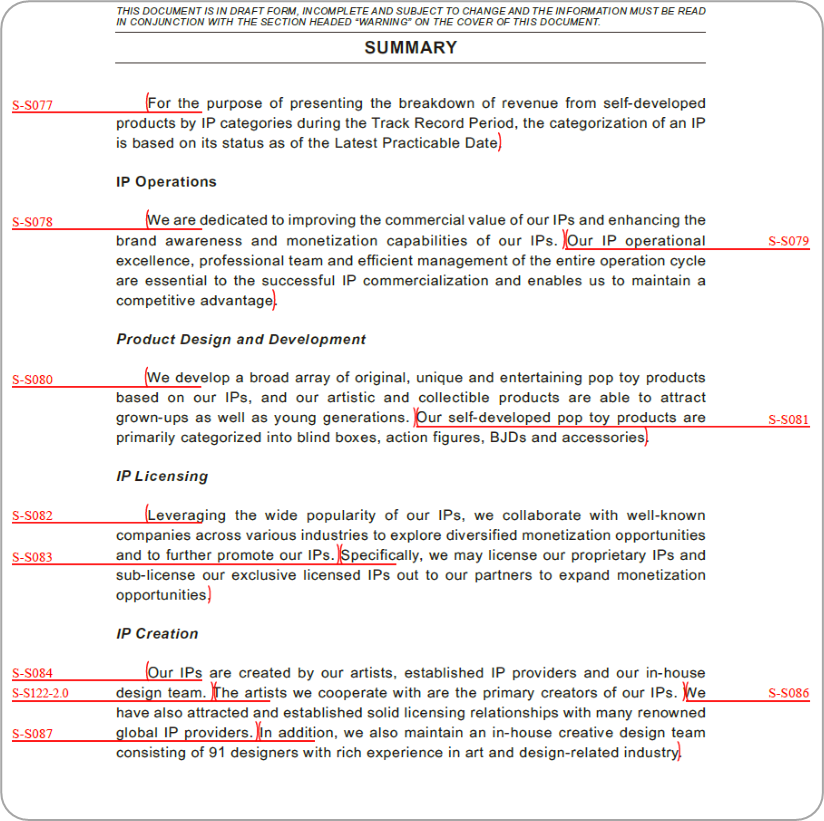

A single prospectus can contain over 10,000 statements and data points scattered across risk factors, business descriptions, MD&A, financial information, and expert sections. Distinguishing which statements are material—and whether they express factual assertions or subjective views—is a non‑trivial, judgment‑intensive task. Without structure, verification grids balloon in size, and teams rely on manual tagging and spreadsheets that are easy to break and hard to keep synchronized with evolving drafts.

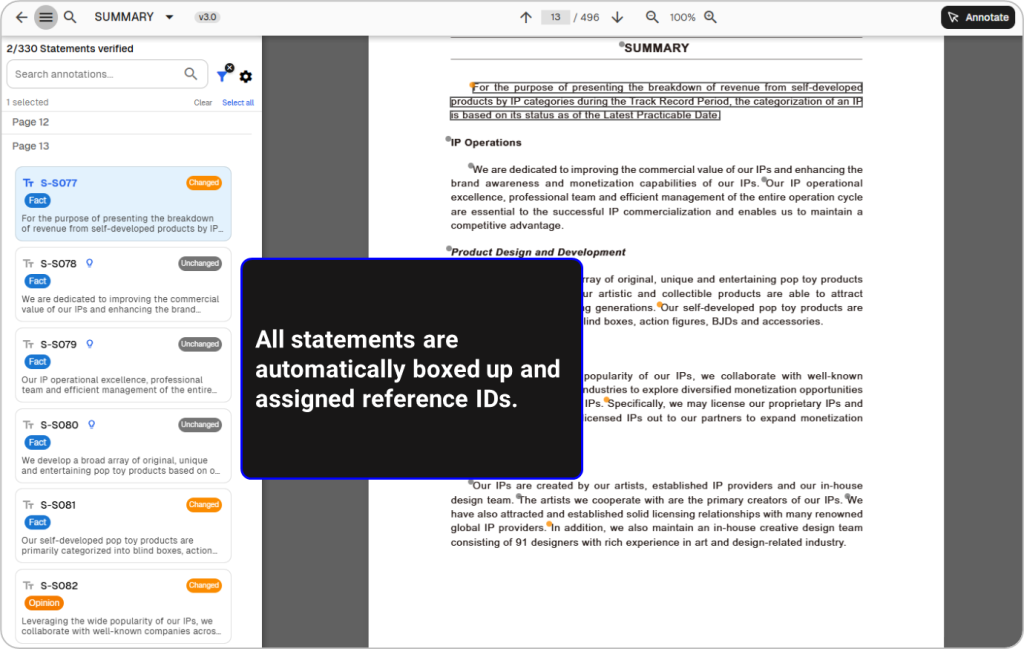

Factify automatically parses the prospectus, identifies material statements, and classifies them into categories such as Facts and Opinions. This gives deal teams a structured verification universe from day one: factual statements can be routed into evidence‑based checking, while opinions and forward‑looking statements can be channelled into judgment calls and director confirmations. By turning a flat document into an organized statement registry, Factify ensures nothing material is missed and enables teams to focus attention where it matters most.

Pain point 2: repeated statements across sections

Key disclosures—such as revenue figures, customer metrics, regulatory approvals, or risk narratives—often appear multiple times across different sections and even in different formats. When a number is updated or a narrative is refined, every occurrence must be identified and refreshed; any missed duplicate becomes a potential inconsistency that can undermine confidence in the document. Teams typically rely on manual searching, line‑by‑line comparison, or fragile Word comparison files to track these repetitions.

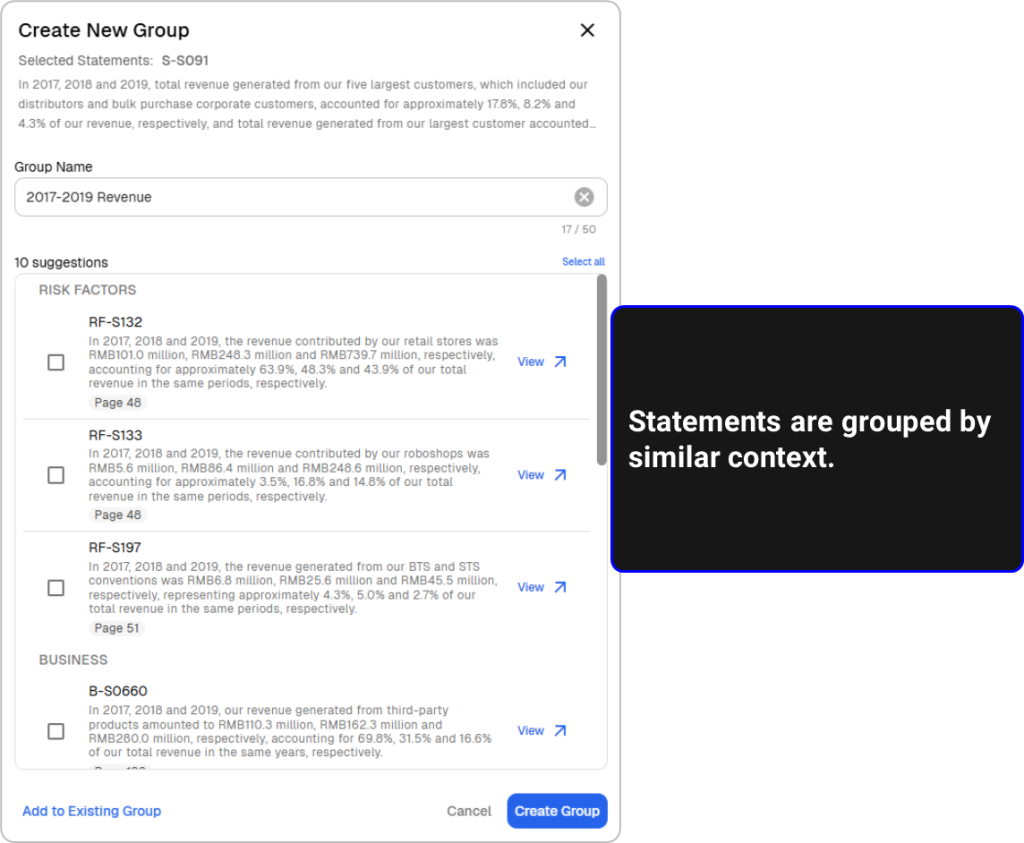

Factify intelligently groups similar and repeated statements across the prospectus through AI-driven recommendations. When a user reviews or updates the verification of a statement in one section, they can immediately see linked or similar statements elsewhere and propagate verification decisions or checks accordingly. This reduces redundant effort, ensures consistent treatment of the same disclosure across the document, and minimizes the risk of misalignment when figures or wording change late in the process.

Pain point 3: chasing issuers for the right documents

A major friction point in verification is the iterative process of requesting supporting documents from issuers and advisers. Even experienced teams can struggle to specify exactly which document types are required at the outset—especially for complex businesses with multiple subsidiaries, contracts, or regulatory interfaces. This leads to piecemeal requests, back‑and‑forth emails, and incomplete document sets that delay verification work.

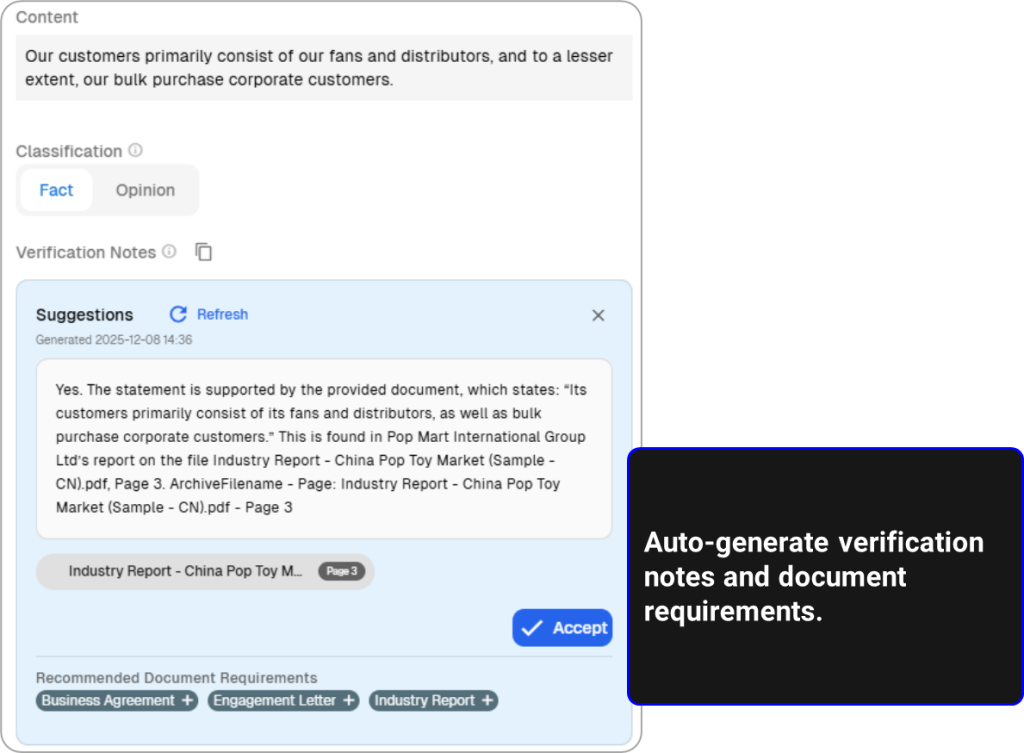

Factify closes this gap by suggesting required document types based on the prospectus content and the verification scope. As the system analyzes statements—such as revenue breakdowns, licenses, material contracts, or operational metrics—it can propose a structured requirement list (for example, audited financial statements, license certificates, key contracts, board minutes, expert reports). Users can review and refine this list, then share it directly with the issuer as a clear, transaction‑specific document request pack. This streamlines communication, reduces misunderstandings, and allows both sides to start from a shared, transparent checklist.

Pain point 4: linking thousands of documents to statements

Once documents arrive, the real work begins: each factual statement must be linked back to specific evidence. In large deals, teams can easily end up with thousands of supporting documents—financial statements, management accounts, contracts, internal reports, regulatory filings, expert opinions, and more. Manually scanning, interpreting, and citing these materials for every factual statement can consume weeks and still leave gaps.

Factify automates this heavy lifting by screening all uploaded documents and suggesting verification citations for each factual statement. The system identifies relevant passages, pages, and sections across the document corpus and proposes links back to the statements in the prospectus. It can also generate draft verification notes that explain how a statement has been verified (for example, which document, which page, and what the supporting wording or figure is). Deal teams remain in control—they review, accept, or refine the suggested citations and notes—but the bulk of the searching and initial drafting is handled by the platform, turning weeks of manual effort into a far more manageable, curated review process.

Pain point 5: diverse, unstructured, and non‑English documents

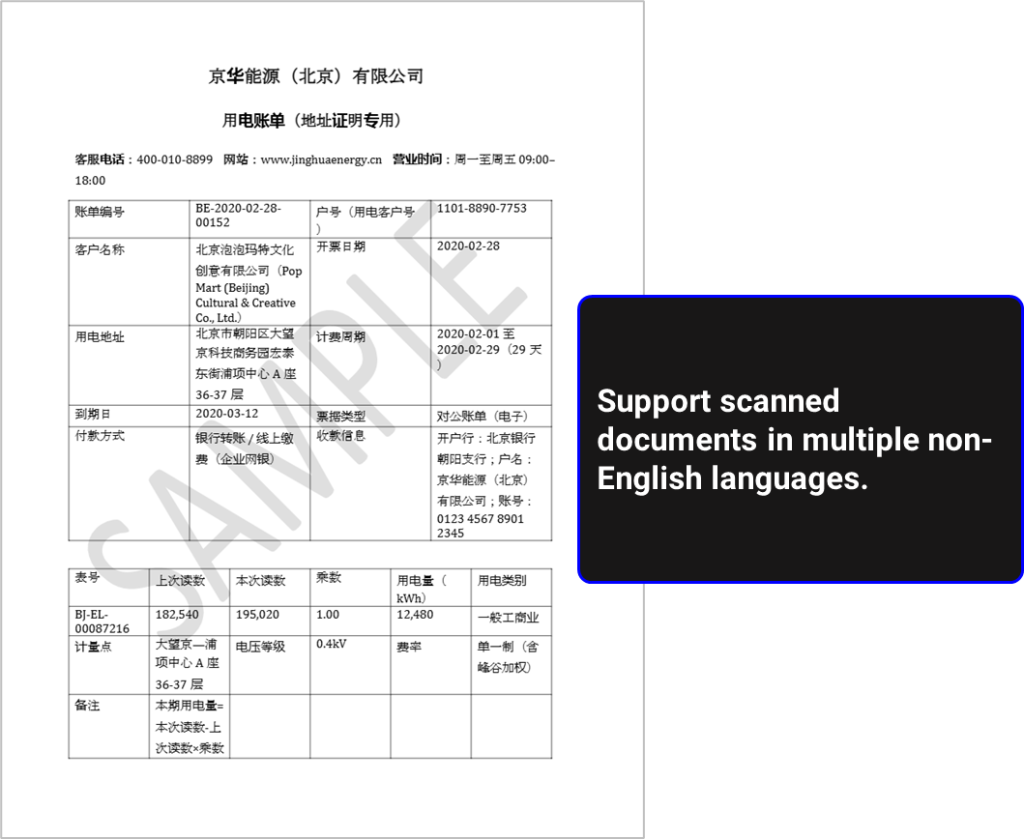

Supporting materials from issuers are rarely uniform. They may include scanned PDFs, images, slide decks, and forms, often in Chinese or mixed languages. Traditional OCR tools struggle with low‑quality scans, complex layouts, or bilingual content, and manual transcription is both slow and error‑prone. This significantly slows down verification and creates a risk that important details in non‑searchable documents are overlooked.

Factify incorporates cutting‑edge vision models capable of handling different document formats and images in multiple languages, including Chinese. It can extract text from scanned documents, understand layout and context, and make that content searchable and referenceable for verification. This allows teams to treat scanned and image‑based documents much like native digital files—searching within them, attaching them as evidence, and relying on the same AI-driven citation suggestions—without needing separate conversion workflows or manual retyping.

Pain point 6: version churn across hundreds of pages

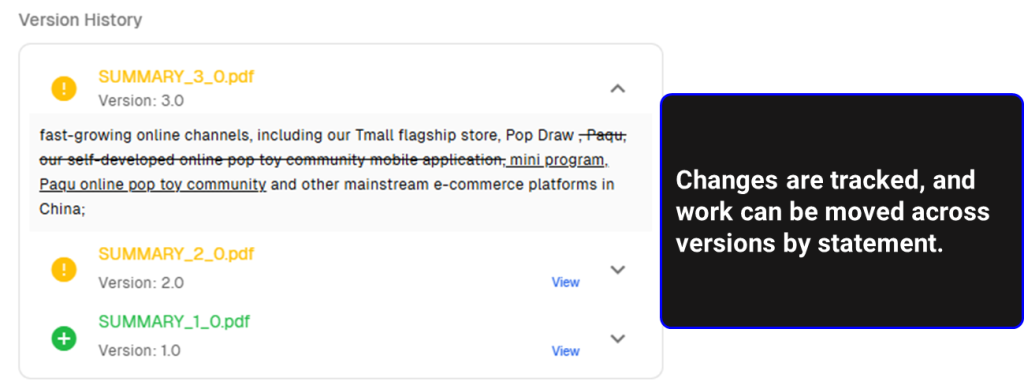

Hong Kong IPO prospectuses often span hundreds of pages, and each draft iteration can contain changes across many sections. Tracking what changed, where it changed, and how those changes affect previous verification work is extremely challenging. Without proper version control, teams risk duplicating work, missing updates, or losing clarity on which statements have been fully verified in the latest draft.

Factify addresses this by providing section‑by‑section version tracking and work migration. When a new draft is uploaded, the platform can map sections and statements against the previous version, highlight changes, and carry forward verification work where content remains unchanged. Users see exactly which sections need fresh attention and which can rely on migrated verification, allowing them to focus on genuine deltas rather than re‑validating the entire document. This reduces turnaround time and offers a clear audit trail of how verification evolved across drafts.

Pain point 7: assembling the final verification pack

At the end of the process, teams must compile a comprehensive verification pack for internal committees, clients, and regulators. This typically includes verification notes, annotated prospectus copies, evidence citations, and supporting documents—often scattered across shared drives, email threads, and standalone spreadsheets. Preparing this pack is time‑consuming, error‑prone, and usually falls to senior team members when time pressure is highest.

Factify enables users to seamlessly export all verification work in one go. The platform can produce an integrated verification pack that includes the annotated prospectus, statement lists, verification notes, and linked supporting documents, structured in a way that is easily navigable for reviewers. This not only saves substantial time at the closing stage but also provides a more robust, consistent record of verification decisions for future reference, audits, or regulatory inquiries.

By directly targeting the most painful parts of the verification lifecycle—statement structuring, repetition management, document requests, evidence linkage, unstructured content, version churn, and final pack preparation—Factify frees IPO teams to focus on what they do best: exercising judgment, advising clients, and safeguarding market integrity. Instead of scaling headcount to keep pace with growing deal volumes and regulatory expectations, firms can scale intelligently with AI-native infrastructure that makes high‑quality verification faster, more defensible, and more sustainable.

Learn More

- Learn more by visiting the Factify product page.

- Watch the Factify teaser video.

- Contact us for a demo session.