Hong Kong’s IPO engine has roared back to life, but the very boom that restores the city’s global leadership is now testing the limits of traditional verification workflows.

A market that bounced back faster than workflows

Hong Kong reclaimed the world’s top spot for IPOs in 2025, with 114 companies raising about US$37.22 billion on the main board, marking the strongest year since its 2021 peak. Funds raised in the first half of 2025 alone surged sevenfold year on year to HK$107.1 billion across 42 listings, the best first-half performance since 2021. By the first nine months of 2025, 66 companies had raised US$23.27 billion, cementing Hong Kong’s grip on the top of global rankings and setting the stage for continued momentum into 2026. This year’s opening has been equally intense: January saw nearly 100 new listing applications and one of the strongest starts in recent years, underscoring how quickly the pipeline has swelled.

When volume becomes a risk factor

The surge in deal flow is stretching sponsors, law firms, and other advisers who must still meet the same high bar for due diligence and disclosure quality. The Securities and Futures Commission (SFC) has already flagged “serious deficiencies” in many recent listing documents, including poor-quality submissions and weak responses to regulatory queries. In response, the SFC suspended vetting on 16 listing applications and ordered 13 major investment banks to review their work procedures, staffing, and resource allocation. The regulator has also warned that principals handling more than six active IPOs may be deemed inadequately resourced, signalling that capacity constraints are now a systemic concern.

Why robust verification matters more than ever

In this environment, robust verification is not just a compliance requirement; it is central to market integrity and investor confidence. Poorly substantiated disclosures expose issuers and sponsors to regulatory intervention, reputational damage, and potential civil or even criminal liability. With deal teams juggling multiple transactions, manual sampling-based checks and spreadsheet-driven tracking significantly increase the risk of omissions, inconsistencies, and misinterpretations across lengthy prospectuses and supporting documents. The message from regulators is clear: scaling deal volume cannot come at the expense of verification quality or proper supervision of the IPO process.

How AI can transform IPO verification

AI offers a path to reconcile high-volume deal pipelines with uncompromising verification standards. Modern AI systems can automatically structure every statement in a prospectus, classify whether it is factual, subjective, or a regulatory requirement, and match factual statements against underlying evidence such as financial statements, legal opinions, and industry reports. This shifts verification from manual, line‑by‑line review towards a triaged, risk‑based approach where teams focus their attention on exceptions, gaps, and high‑judgment areas. AI also enables better governance by centralizing audit trails, surfacing verification status in real time, and supporting collaboration between sponsors, issuers, and counsel in a single digital workspace. When implemented correctly, AI augments professional judgment rather than replacing it, giving teams the tools to maintain quality even as deal flow accelerates.

Factify: AI-native infrastructure for IPO due diligence

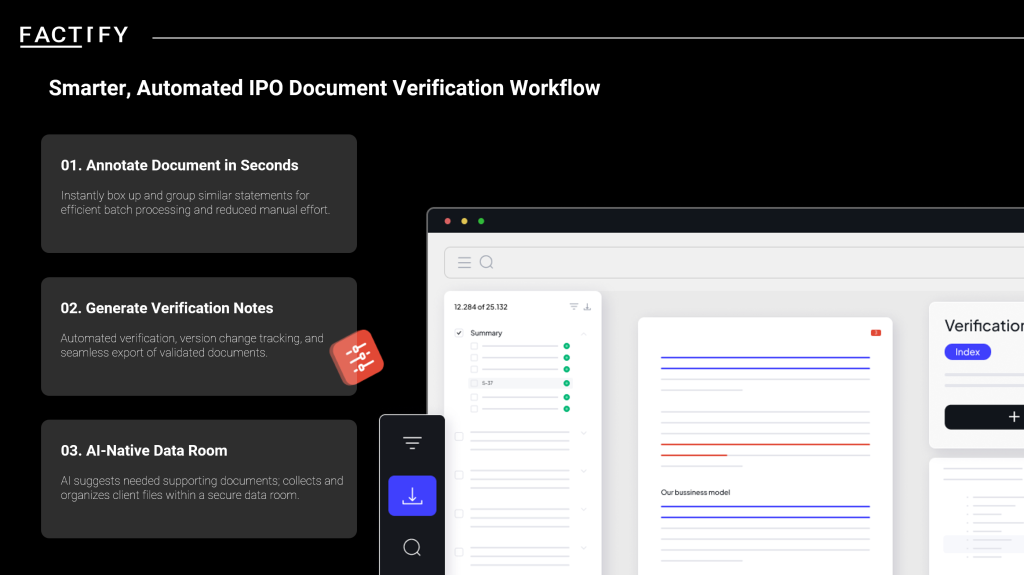

Wizpresso Factify is designed specifically to solve the verification bottleneck now confronting Hong Kong’s IPO ecosystem. As an AI-powered due diligence platform, Factify automatically ingests draft prospectuses, identifies material statements, assigns reference IDs, and classifies each statement by type to determine the appropriate verification treatment. For factual disclosures, Factify cross-checks against uploaded supporting documents—including financials, contracts, expert reports, and legal opinions—highlighting where evidence is missing, inconsistent, or outdated. Subjective statements and director confirmations are flagged for explicit sign‑off, ensuring that judgment calls are documented and traceable for regulators and internal review.

Factify 2.0 introduces AI‑generated verification notes, automated scope recommendations, and linkage suggestions that guide teams on which sections and issues to prioritize across large, complex transactions. A compliance Q&A engine and analytics dashboards provide real-time visibility into verification progress, open points, and resource allocation across deals, enabling partners and principals to maintain effective supervision even at high volumes. By reducing manual verification cycles and centralizing collaboration within an audit‑ready environment, Factify helps sponsors, issuers, and legal advisers save up to 75% of the time traditionally spent on verifying regulated disclosures while improving accuracy and consistency.

As Hong Kong enters a new phase of IPO growth, the firms that will lead are those that pair market opportunity with operational resilience and technological leverage. With Factify, Wizpresso aims to provide the AI backbone that allows market participants to scale their IPO practices responsibly—meeting heightened regulatory expectations, protecting investor trust, and ensuring that Hong Kong’s renewed IPO leadership is built on a foundation of high‑quality disclosure.

Learn More

- Learn more by visiting the Factify product page.

- Watch the Factify teaser video.

- Contact us for a demo session.