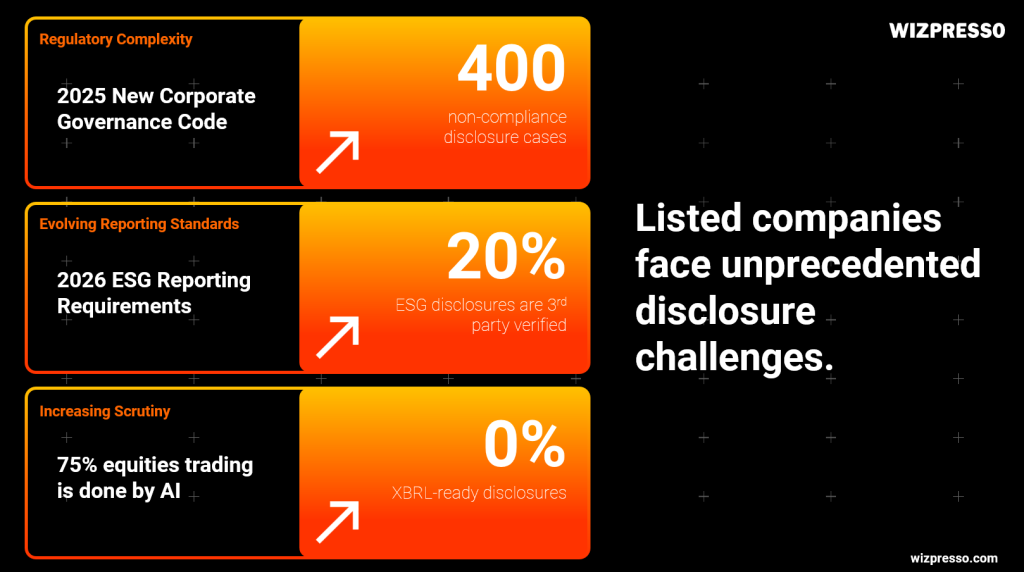

Hong Kong’s listed companies are facing a new era of regulatory complexity. The introduction of the 2025 Corporate Governance Code, evolving ESG reporting requirements, and the increasing reliance on AI-driven trading have converged to create an environment where disclosure standards and investor transparency are under greater scrutiny than ever before.

The Compliance Landscape: Key Challenges

Recent industry discussions highlight several pressing challenges for HK-listed companies:

- Regulatory Complexity: The 2025 New Corporate Governance Code has driven up the number of non-compliance disclosure cases to 400 annually, reflecting the mounting burden on companies to accurately meet regulatory expectations.

- Evolving Reporting Standards: From 2026, new ESG reporting requirements will compel issuers to provide more granular disclosures, yet only 20% of ESG disclosures are currently verified by third parties, undermining investor trust and corporate accountability.

- Increasing Scrutiny: As much as 75% of equities trading in Hong Kong is now conducted by AI, but the lack of XBRL-ready disclosures (currently at 0%) exposes gaps in automation and market transparency.

Wizpresso’s Approach: Leveraging AI for Better Compliance

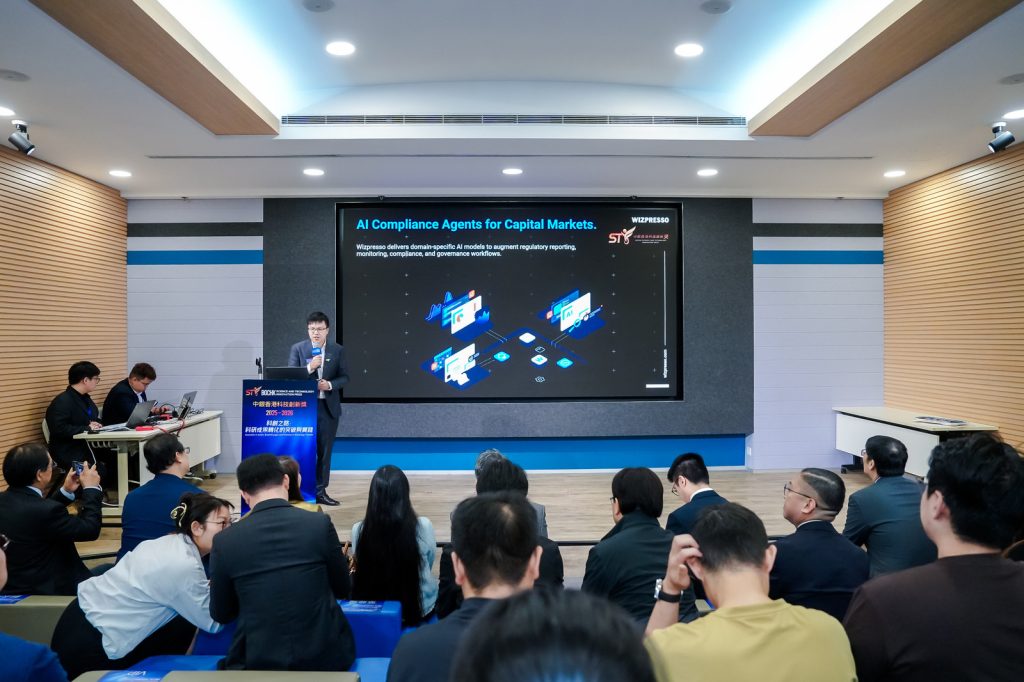

Calvin Cheng, Wizpresso’s founder, shared these challenges at the recent Bank of China (Hong Kong) – Innovation in Action event, emphasizing the urgent need for advanced RegTech solutions to address compliance gaps. Wizpresso is at the forefront with its AI-powered platforms—Factify and Diligence—designed specifically for compliance monitoring, disclosure verification, and risk management.

- Automated Disclosure Verification: Wizpresso’s Factify AI engine reviews every statement against supporting documentation, ensuring completeness and accuracy for IPO prospectuses, annual reports, and ESG filings.

- Real-Time Gap Analysis: Diligence enables organizations to benchmark disclosures and policies directly against regulatory frameworks, performing AI-powered gap analysis to quickly identify non-compliance before it becomes a risk.

- Enhanced Transparency: Both platforms facilitate collaboration with audit trails, secure data rooms, and evidence-backed verification, empowering issuers, regulators, and investors to make informed decisions based on trusted disclosures.

Raising the Bar for Market Transparency

Wizpresso’s commitment is to transform disclosure standards and align Hong Kong’s listed companies with best practices. By automating compliance checks and centralizing evidence collection, Wizpresso’s technologies significantly reduce manual review cycles, decrease compliance costs, and increase the speed and quality of regulatory reporting.

Industry leaders, regulators, and investors are now able to monitor disclosures more closely and advocate for greater market transparency—ensuring Hong Kong maintains its reputation as a robust, trusted global financial hub.

As regulatory requirements continue to evolve, companies must adapt swiftly to meet growing expectations for disclosure accuracy and stakeholder confidence. Wizpresso will continue to innovate, empowering organizations to navigate regulatory change, close compliance gaps, and set new standards for transparency in capital markets.

For more on how Wizpresso is transforming compliance and disclosure in Hong Kong, explore our latest AI-powered solutions or contact us for a demonstration.

Learn more about Diligence: https://wizpresso.com/RegulatoryReporting/Diligence

Learn more about Factify: https://wizpresso.com/RegulatoryReporting/Factify