Environmental, Social, and Governance (ESG) criteria are no doubt becoming increasingly integral to the Hong Kong market landscape. These criteria provide a framework for assessing the sustainability, climate change and ethical impact of a company as well as relevant stakeholders, focusing on how they manage environmental responsibilities, social relationships, and governance structures. ESG has shifted from a peripheral consideration to a central aspect of corporate strategy, driven by stringent regulations and heightened stakeholder expectations.

The Hong Kong Stock Exchange (HKEX) has been at the forefront of promoting ESG. Since 2016, HKEX has mandated annual ESG reporting, emphasizing transparency and accountability. This requirement ensures that companies disclose relevant information on their environmental impact, governance practices, and social contributions. The HKEX’s consultation conclusions set on new climate disclosure requirements, became effective from January 1, 2025, established the foundation of ESG in Hong Kong’s regulatory landscape.

In particular, the government and HKEX’s proactive stance towards ESG is evident in their various initiatives aimed at fostering sustainable finance—a sector that takes hold of a significant portion of Hong Kong’s economy. For instance, the Green and Sustainable Finance Cross-Agency Steering Group plays a crucial role in promoting ESG practices across the financial sector. This collective effort by regulatory bodies underscores the significance of ESG for Hong Kong’s markets.

Hong Kong’s unique position as a global financial hub amplifies the impact of ESG principles. The city’s dense urban environment and significant role in international finance mean that sustainable practices adopted here can have widespread environmental and social implications far beyond the boundaries of the city. As companies in Hong Kong on one hand align with global ESG standards, and they should also embrace local and / or regional challenges. These companies big or small not only on the upside enhance their reputation but also attract international investment and on the downside protect and secure their position.

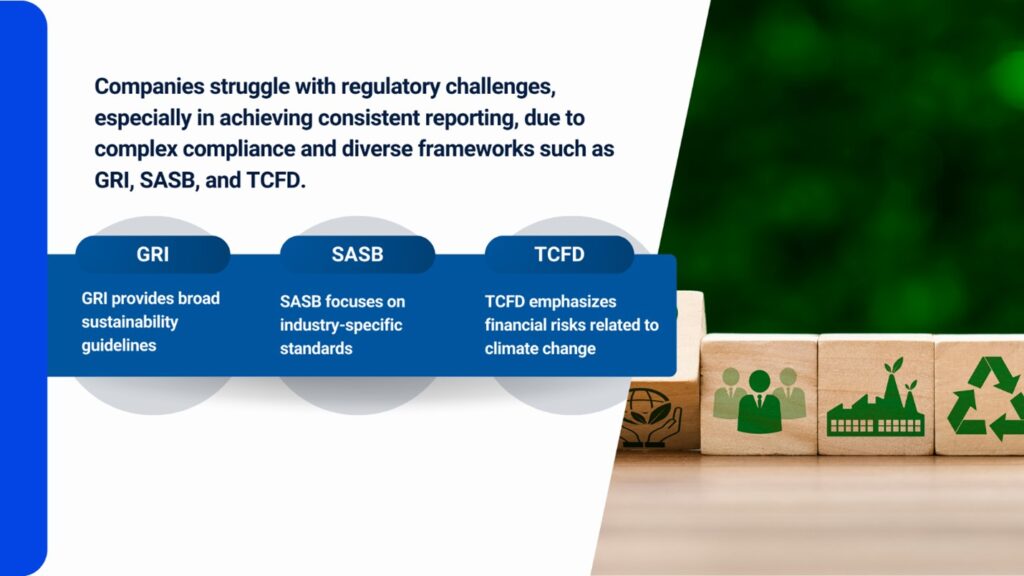

Despite these advancements, companies face several challenges and complications in ESG regulations, policies and requirements. One major challenge is ensuring consistent and comprehensive reporting. The complexity of regulatory landscapes and the associated compliance costs can be daunting. The diversity of ESG frameworks, including but not limited to the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Task Force on Climate-related Financial Disclosures (TCFD), adds to this complexity.

Each framework offers unique advantages for example: GRI provides broad sustainability guidelines, SASB focuses on industry-specific standards, and TCFD emphasizes financial risks related to climate change. This diversity, while beneficial, can also be confusing for companies trying to adopt the most relevant standards for their operations, and serves as a prominent reminder on just how many layers there are to working with ESG in all its complexity. This is a walk of life.

Regardless, for stakeholders, ESG reporting is not just a compliance exercise but nonetheless a crucial tool for defining and making informed decisions. Transparent ESG information helps investors assess risks and opportunities, regulators ensure compliance, customers trust brands, and employees feel engaged. In Hong Kong, these interconnected parties drive the market towards more sustainable practices, especially when the economy is so reliant on investment, domestic or international.

Global ESG trends significantly influence Hong Kong’s local market. As international investors increasingly demand high ESG standards, Hong Kong companies must align with global practices to remain competitive and at some point it is the minimum standard to get into the doorstep. In or out. In: this alignment helps attract international investments and positions Hong Kong as a leader in sustainable finance. Out: companies will be out of the top tier or 100% out of the market.

If ESG is so important, then how might companies begin to adapt to this new business landscape? Staying updated on ESG trends and best practices is essential for companies. This can be achieved through continuous learning, engagement with industry bodies, attending ESG-focused events, and leveraging digital tools for real-time updates. Such proactive engagement ensures that companies can align with global standards and enhance their ESG performance, ensuring long-term sustainability and competitiveness.

ESG Challenges create demand for additional technology and services

At the end of the day, both the buy-side and sell-side face common challenges in ESG. On the buy-side, investors demand more detailed and reliable ESG data to make informed decisions. On the sell-side, companies struggle with the costs and complexities of comprehensive ESG reporting. To bridge this gap, the role of external consultants becomes crucial. These specialists help companies understand regulatory requirements, implement best practices, and prepare thorough ESG reports that meet investor expectations.

Ultimately, companies that embrace and adopt ESG principles and practices find themselves in the perfect spot to thrive in the ever-changing Hong Kong market landscape.