In the dynamic world of finance, equity research emerges as an indispensable tool for investors navigating the complexities of the stock market. With its focus on evaluating listed companies, determining their valuation, and providing expert recommendations, equity research plays a pivotal role in informed investment decision-making. Therefore, the ability to conduct thorough and diligent research is crucial for analysts in the ever-changing capital markets.

What is Equity Research?

Equity research involves a thorough examination of listed companies and their operating environments to assess their financial performance, industry dynamics, and growth prospects. This comprehensive analysis encompasses evaluating financial statements, conducting ratio analysis, and utilizing financial modeling techniques to forecast future performance. By conducting research, investors can effectively evaluate the potential risks and rewards of different investment opportunities.

Analysts employed in sell-side firms, including investment banks and brokerage firms, play a crucial role in this process. Their primary objective is to determine the intrinsic value of a company’s shares and provide insightful recommendations to investors. They produce research reports and offer investment guidance to clients, serving as valuable resources for investors and hedge fund managers in discovering market opportunities and making well-informed financial decisions. For companies and industries, the value of equity research lies in the detailed coverage of their company, their competitors, and how they perform related to the marketplace they are within.

Components in an Equity Research Report

The contents of an equity research report can vary to some degree based on the discretion of analysts and investment banks. However, there is a general framework that research reports typically adhere to meet investors’ expectations. Here is an overview of the key components typically included in a standard equity research report:

- Recent Results and Announcements: This section covers important events such as quarterly results, guidance, and general updates provided by the company.

- Upgrades/Downgrades: Upgrades or downgrades reflect the analyst’s revised positive or negative outlook on the valuation of a particular stock. These assessments are often based on a combination of qualitative and quantitative analysis that impacts the financial valuation of the security.

- Estimate/Price Target Revisions: Estimates involve detailed projections of a company’s future earnings over the next several years, which are used to establish price targets. Price targets are derived from assumptions regarding the asset’s future supply and demand dynamics and fundamental factors.

- Management Overview and Commentary: This section provides insights into the quality and composition of a company’s management team. It may include information about the leadership history, capital allocation practices, environmental, social, and governance (ESG) considerations, executive compensation, incentives, and stock ownership. Additionally, an overview of the company’s board of directors may be included.

- Industry Overview: This section examines the company’s position within its sector and covers competitors and industry trends. Industry research encompasses various factors such as political, economic, and social trends, technological innovations, and more.

- Historical Financial Results: This section presents a historical overview of a company’s stock performance and expectations based on current market conditions and relevant events. Analysts analyze the historical data of the specific industry to identify patterns or trends that support their recommendations and determine if the company meets or exceeds market expectations.

- Valuation: Analysts run equity valuation models based on market analysis, historical financial results, and other relevant factors. These models can include absolute valuation models, which calculate a company’s intrinsic value, as well as relative equity valuation models, which assess a company’s value in relation to another company or asset using metrics such as price/sales, price/earnings, and price/cash flow ratios.

- Recommendations: Equity research analysts provide recommendations to buy, hold, or sell a stock. They also assign a target price that indicates their expected stock price within a year.

Challenges in Conducting Equity Research

As equity research analysts, professionals face specific challenges throughout the research process that can impact the quality and effectiveness of their analysis. The following are key obstacles they encounter:

- Limited Information Availability: Obtaining comprehensive and up-to-date information about companies, particularly in emerging markets, can be difficult. Inadequate disclosure requirements or restricted access to management hinder the availability of crucial data.

- Data Quality and Reliability: Ensuring the accuracy and reliability of data poses a challenge. Analysts rely on precise and consistent financial information for thorough analysis. However, discrepancies, inconsistencies, or errors in financial statements can impact the reliability of their research.

- Industry Complexity: Equity research requires in-depth knowledge and understanding of specific industries. Industries can be intricate, characterized by unique dynamics, regulations, and factors influencing company performance. Analysts must remain updated on industry trends and changes to provide informed recommendations.

- Time Constraints: Equity research is time-sensitive, and analysts often face tight deadlines. Staying abreast of company news, industry developments, and market events requires continuous monitoring and swift analysis. Meeting deadlines can be challenging, particularly when dealing with an extensive coverage universe.

- Market Volatility and Uncertainty: Equity markets are prone to volatility and uncertainty, which can significantly impact investment decisions. Analysts must navigate market fluctuations, economic shifts, geopolitical events, and regulatory changes, integrating them into their research to provide accurate assessments.

How to leverage Wizpresso Filingseer for Sell-side Research

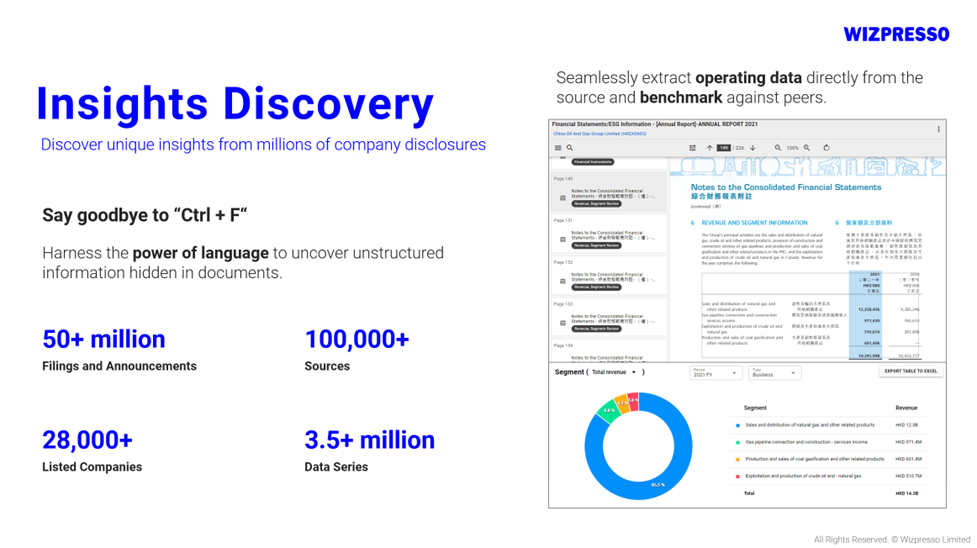

Filingseer is an AI-powered search engine that empowers investment banking and financial advisory professionals to find insights from millions of documents in seconds. Here are a few examples of how Filingseer can help:

- Extract financial and operating data directly from PDF documents

- Instantly generate all historical disclosures based on specific context

- Receive notifications on new disclosures published by your clients

Filingseer enables you to quickly find relevant disclosures from listed companies and extract tabular or machine-readable financial and operating data into Excel directly from the documents.

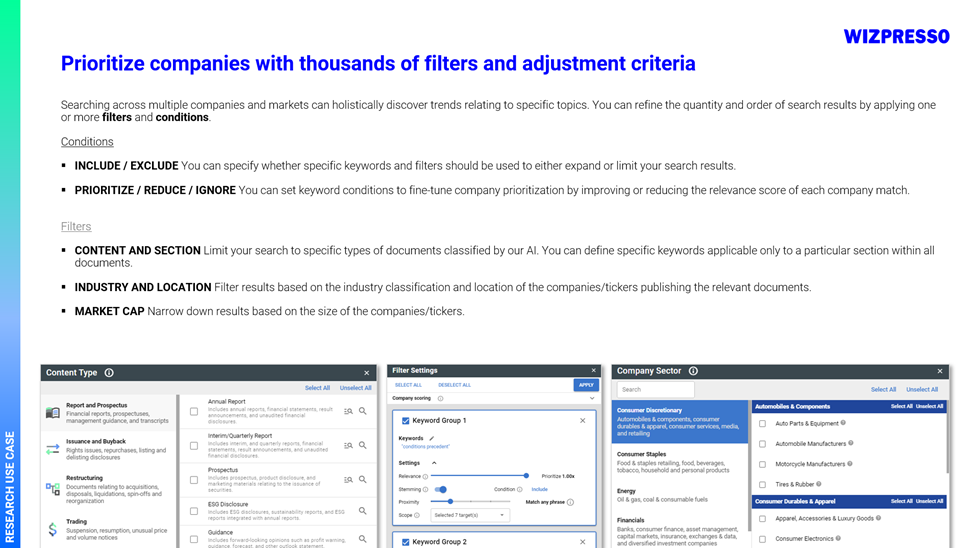

Filingseer offers advanced keyword, field, and content-specific search capabilities to cater to your needs. Users can utilize a diverse range of content filters to comb through content quickly and apply additional keyword searches.

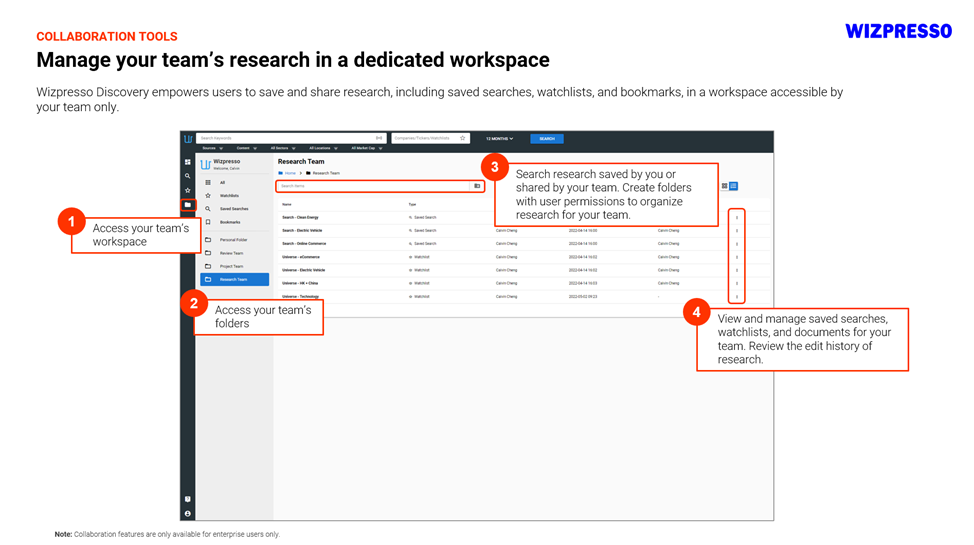

Filingseer is also equipped with a workspace management tool that enables your team to manage your research in a dedicated and secured environment. Users can create watchlists, saved searches, and bookmarks and share them using comprehensive access management and control features.

Learn more about Filingseer: https://wizpresso.com/MarketIntelligence/Filingseer