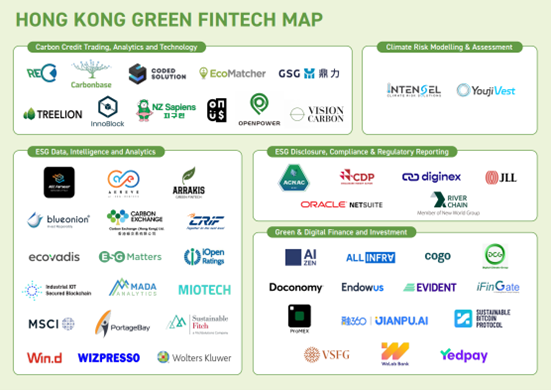

Wizpresso Featured in Prototype Hong Kong Green FinTech Map 2024, Empowering Listed Companies’ ESG Transformation with Latest AI Technology

April 2024 – The global rise in green and sustainable finance has led to heightened regulatory scrutiny worldwide. In response, the Hong Kong Government and its affiliated entities have initiated the Green Fintech Prototype program. This program highlights pioneering FinTech firms driving sustainability across five key categories, spotlighting the foremost topics dominating the landscape of […]