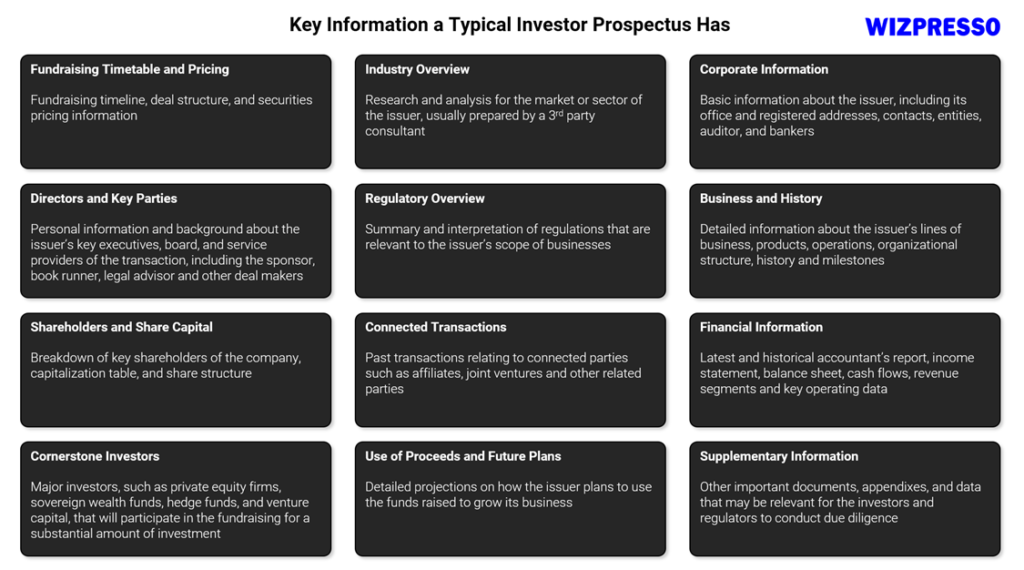

When companies fundraise using debt (e.g., bond issuance) or equity (e.g., initial public offering), they prepare a book called the prospectus for investor roadshows and marketing. Investors typically refer to a prospectus for crucial information about the company, including but not limited to the following:

A prospectus often contains hundreds of pages with detailed information about the fundraising arrangements, company businesses and operating environment, and financial performance. Regulators require all information disclosed on the prospectus to be accurate and not misleading. As a result, the prospectus undergoes a rigorous verification process where each statement within must be reviewed and cited. Failure to do so may lead to delays in obtaining approvals from regulators, litigation risks, and reputational damages.

So, who is responsible for ensuring that the content of a prospectus is trustworthy and factual? The Sponsor (ie. the investment bank or financial advisor) – and in Hong Kong, verification work is often carried out by the legal advisor to the sponsor.

The Role of the Legal Advisor

There are often two legal advisors to a transaction; they are:

- Legal Advisor to the Issuer – advising the issuer/company on legal matters and responsible for drafting the prospectus

- Legal Advisor to the Sponsor – advising the sponsor on legal matters and responsible for verifying the prospectus

How Lawyers Verify a Prospectus

- Reviewing the prospectus: lawyers meticulously review the prospectus to ensure it contains all the necessary and relevant information about the issuer.

- Ensuring legal compliance: lawyers ensure that all legal issues related to the prospectus, such as corporate governance structure, regulations, and other legal risks and impacts, are adequately addressed.

- Conducting legal due diligence: lawyers conduct comprehensive due diligence to identify any legal issues or risks associated with the company.

- Communicating with regulators: lawyers communicate with regulators throughout the fundraising application process to ensure the company complies with all securities regulations and regulatory requirements.

The Time It Takes to Verify a Prospectus

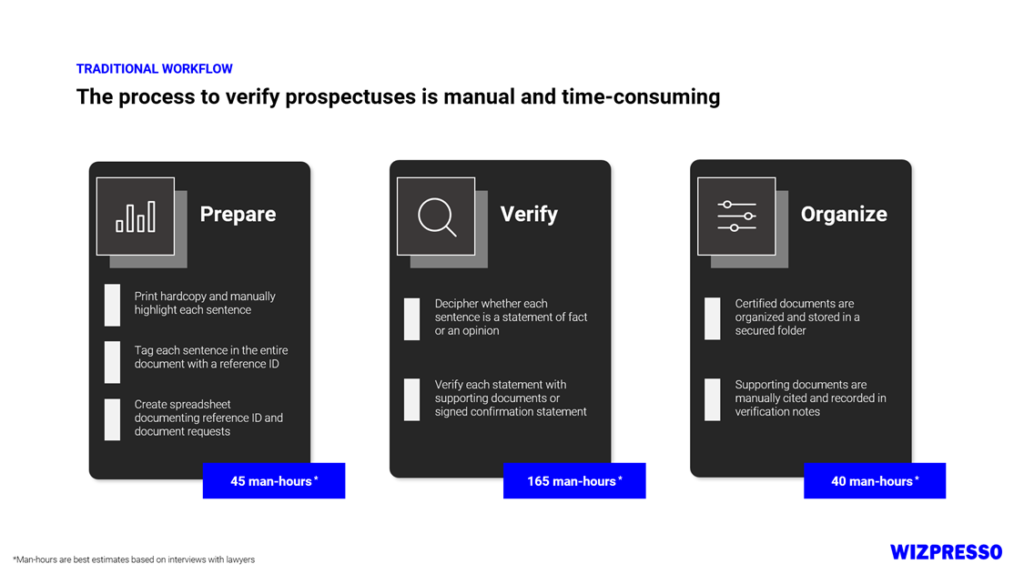

The traditional verification process involves three main steps, each of which requires significant time and effort:

Preparation phase (about 45 hours)

- Print hardcopy of the prospectus and manually highlight each statement within

- Assign each statement in the entire document with a reference ID

- Create a spreadsheet documenting reference IDs and generate a document requirement/request list based on the information disclosed by the issuer

| Factify speeds up preparation by 95% Upon uploading a prospectus, all statements will automatically be boxed up with a reference ID assigned within minutes. Material statements are automatically identified and classified as facts and opinions. |

Verification phase (about 165 hours)

- Each statement is reviewed to determine the scope of verification; based on the context, statements are classified as facts or opinions

- Lawyers prepare verification notes based on the type of statements:

- Opinions are verified with a signed confirmation statement from the director(s)

- Facts are verified by citing or referencing information from supporting documents

- Lawyers prepare verification notes based on the type of statements:

- Verification notes are compiled and exported for sponsors to review.

| Factify can recommend documents and content within supporting documents for verification Factify’s proprietary verification AI understands the context of material statements and recommends relevant supporting documents and content for verification. Users can also utilize built-in collaborative tools to assign work and track verification progress in real time. |

Organization phase (about 40 hours)

- Certified documents are collected from the issuer, organized, and stored in a secured folder

- Supporting documents are manually reviewed and referenced in verification notes

- When the prospectus is updated, changes are tracked, and verification notes are manually moved to the latest version

| Factify supports multiple languages and is integrated with enterprise-grade cybersecurity measures Users can upload multiple versions of the same prospectus to track changes and move work to the latest version using Factify’s award-winning version control features. Supporting documents can be stored and managed using a document management system secured with AES256 encryption. |

With the advancement of technology, AI has become widely adopted across professional services to streamline repetitive workflows. In verification, the emergence and popularization of natural language processing (NLP) technology have significantly improved workflows. Goldman Sachs predicted that almost half of all current tasks in the legal profession could be replaced by AI (Criddle, 2023).

Conclusion

AI technology enables the rapid processing of vast amounts of data and the automatic identification and analysis of key information. This reduces the time and cost associated with manual review and verification, helping IPO lawyers better assess the company’s risks and opportunities and improving legal advice. In sum, the emergence of AI technology has revolutionized lawyers’ work by enhancing prospectus verification and review efficiency and accuracy.

Learn more about Factify: https://wizpresso.com/RegulatoryReporting/Factify