ESG, also known as environmental, social, and governance, is a set of aspects and an analytical framework to evaluate companies when investing. The framework enables investors to look beyond traditional financial metrics by considering companies’ impact on the environment, stakeholders, and society as a whole. Furthermore, ESG also deals with how a company manages risks and opportunities in a changing market to generate and maintain long-term shareholder and societal value.

ESG is not a new concept and has started decades ago.

Timeline of ESG

1960s – As per “ESG – A Brief History of its Development,” ESG started when the book “The Silent Spring” was published. It tackles the environmental effects of using pesticides. This was also the start of environmental movements, making corporations accountable for the dangerous effects of their activities. This results in investors removing certain businesses from their portfolios.

1980s – ESG helped end Apartheid (racial segregation) in Africa. Many U.S. corporations divested themselves from South Africa, resulting in economic instability. At this time, the “Comprehensive Anti-Apartheid Act” was passed, which outlawed any additional investments.

1990s – United Nations Framework Convention on Climate Change, known as the “Earth Summit,” was established in 1992. It was signed by 154 states in Rio de Janeiro. Its goal is to maintain a good level of greenhouse gas concentrations to hinder any human-related changes in the climate. Global Reporting Initiative (GRI) was also founded in Boston in 1997. This is an independent organization that assists businesses to be accountable for their impacts. It also allows companies to prove their responsible environmental business credentials.

2000s – United National Global Compact is launched. According to Kayla Barnes’s “A History of How Modern ESG Came to Be,” the Global Compact was a call to companies to align strategies and operations with universal principles. In 2004, it also published guidelines for companies to include ESG in their operations – “Who Cares Wins – Connecting Financial Markets to a Changing World.” Different boards and conventions were also launched (Sustainability Accounting Standards Board and United Nations Framework Convention). Its main point was to have standard sustainability, accounting and standard sustainability, accounting and measurements across 77 industries.

2020s – The COVID-19 pandemic brought economic instability, resulting in the World Economic Forum International Business Committee publishing 22 ESG metrics. Larry Fink, CEO of Blackrock, also reiterated that the time to act is now. ESG is the main focus of his Annual Letter to Shareholders in 2021. He explained the impacts of the pandemic and how companies should play a vital role in making the world a better one.

ESG still plays an important role for investors and general managers. Studies have shown that companies that do well in ESG also perform well financially. ESG shows no indication of slowing down and is still in an upward trend.

Dimensions

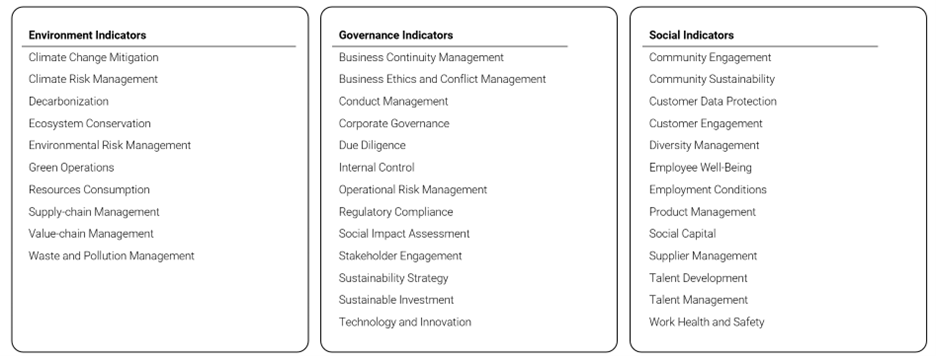

Environment – as the threat and impact of climate change grow, investors may factor in environmental changes that may impact a company’s long-term operations and revenues. In addition, the company’s sustainability and ability to adapt to growing complexities in environmental standards are key factors in determining its environmental risks. The environment dimension covers a wide range of topics, including but not limited to climate change, decarbonization, ecosystem conservation, resource consumption, supply and value chain management, waste and pollution, etc.

Social – a big part of corporate sustainability is how firms effectively manage internal and external stakeholders, including staff, suppliers, community, customers, etc. Studies have shown companies that engage their stakeholders well can better adapt to rapidly changing market conditions. The social dimension covers many themes, including but not limited to community engagement and sustainability, customer engagement and data protection, talent management and development, diversity and employee well-being, product and supplier management, health and safety, etc.

Governance – Corporate governance focuses on the oversight, controls, and policies in place to ensure firms are accountable and transparent to stakeholders. Companies with sound governance frameworks can more effectively manage risks. Governance topics include business continuity management, ethics and conflict management, conduct, due diligence, internal control, operational risk management, regulatory compliance, sustainable strategy and investment, technology and innovation, etc.

Wizpresso Valuelytics

At Wizpresso, we measure companies using a robust ESG framework aligned with global standards, including SASB, GRI, TCFD, HKEX Appendix 27, and more. Our framework comprises 270+ indicators across 35+ themes in ESG.

Wizpresso Valuelytics uses graphical neural network (GNN) and natural language processing (NLP) to extract actionable ESG data from company disclosures and websites at scale. Using proprietary technology, we can more accurately comprehend information hidden in unstructured text, charts and tabular format that traditional data providers may miss.

Contact us today at support@wizpresso.com to gain access to our ESG insights.