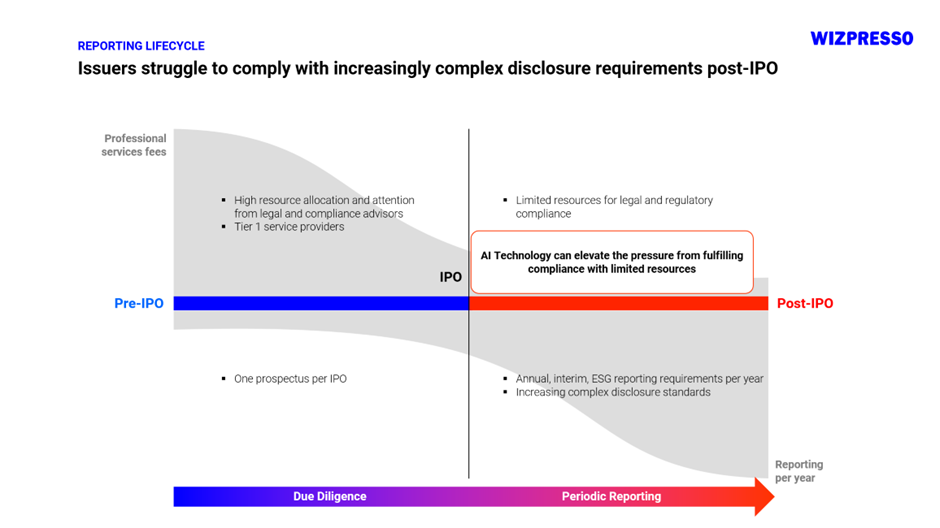

The journey of listing a company can be a complex and challenging endeavor, requiring the submission of various documents and participation in numerous hearings. As an issuer, you understand the significance of accurate and credible public filings in building trust and attracting investors.

The Significance of Verified Reports

When it comes to annual reports and ESG reports, their authenticity holds immense importance in ensuring investor confidence and maintaining transparency. In countries such as the UK and Australia, annual reports are mandatory for listed companies, while comprehensive ESG reporting is increasingly demanded to fulfill responsibilities towards investors and the public. However, ensuring the validity of these reports is often a challenge. How can we be assured of the accuracy of the information presented?

Challenges in Document Verification

In the era of information overload, the task of effectively verifying the authenticity of documents has become increasingly difficult. Traditional verification methods often consume significant time and resources, encountering obstacles such as limited human resources, time constraints, and issues with file duplication.

Specific Reporting Requirements

Different jurisdictions have specific reporting requirements, further complicating the verification process. Let’s take a closer look at the reporting requirements for the UK, Australia, and Hong Kong, which emphasize financial statements, board reports, and governance statements.

United Kingdom

For listed companies in the UK, annual reports are obligatory, as outlined by British Company Law. These reports encompass financial statements, board reports, performance indicators, governance structure, and more.

Australia

Listed companies in Australia are mandated to prepare annual reports following the guidelines set by the Australian Securities Exchange (ASX). These reports include financial statements, board reports, governance statements, and more.

Hong Kong

The Hong Kong Stock Exchange Listing Rules stipulate the information-disclosure requirements for listed companies. The “Hong Kong Financial Reporting Standards (HKFRS)” prescribes the financial reporting standards for listed companies, encompassing income statements, balance sheets, cash flow statements, and more.

ESG Reporting Requirements

ESG reporting has gained significant prominence for listed companies globally, with many countries making it obligatory to fulfill their responsibilities towards investors and the public.

United Kingdom

In the UK, large companies must disclose comprehensive ESG information under the Companies (Miscellaneous Reporting) Regulations in addition to their annual reports. This information covers various aspects related to the environment, society, and governance.

Australia

The ASX’s Corporate Governance Principles require listed companies in Australia to disclose ESG-related information, emphasizing responsible business practices.

Hong Kong

Beginning on January 1, 2024, the Hong Kong Exchanges and Clearing propose to make climate-related disclosures mandatory for all issuers in their ESG reports. This initiative aims to introduce climate-related disclosures in line with the ISSB climate standards.

The authenticity of disclosed information is crucial, and various jurisdictions impose penalties for submitting false information. Here are the penalties for false statements in three locations:

United Kingdom

Company directors in the UK can face penalties for providing false information when submitting documents. Deliberately or recklessly submitting misleading, false, or deceptive information or statements is a criminal offense under the UK Financial Services and Markets Act 2000. Conviction of this offense may result in imprisonment and/or a fine.

Australia

Providing false information to the Australian Securities Exchange (ASX) is illegal under the Corporations Act. Section 1041E of the Corporations Act 2001 prohibits individuals from making false or misleading statements or disseminating misleading information related to financial products. Failure to comply with this provision is considered an offense.

Hong Kong

Hong Kong-listed companies are expected to comply with the Securities and Futures Ordinance and the Listing Rules set by the Stock Exchange of Hong Kong. Failure to provide accurate, complete, and timely information or intentionally submitting false information may lead to regulatory consequences such as fines or other appropriate penalties.

Document Verification Pain Points

Traditional methods of document verification are often time-consuming, labor-intensive and constrained by limited resources, file duplication, and inadequate inter-departmental collaboration. Here are some key pain points:

- Time Limit: The deadline for annual reports is usually around March 31, leaving only three months to complete the report.

- Human Resource Limitations: Finding the right people for verification can be challenging.

- Multi-department Participation: Verification processes often require the involvement of multiple departments, leading to delays in overall progress.

- Difficulty in File Management: Reviewing and verifying multiple files can be prone to duplication of work, and managing multiple file versions can be time-consuming.

AI Platforms for Streamlined Verification

Wizpresso Factify, our award-winning verification software, offers a solution by streamlining the verification process, enhancing collaboration capabilities, and addressing pain points like document organization and version control. Here’s how they can help:

- Collaboration Capabilities: Factify enables work assignments to different departments and provides real-time progress tracking. This ensures everyone can see progress, avoiding delays in overall progress.

- Clear Division of Labor Responsibilities: Factify notifies individuals in real-time about new activities, preventing duplication of work and facilitating timely notifications for improved productivity.

- Document Organization: Factify systematically organizes all documents, making verification convenient.

- Version Control: Factify manages multiple versions of documents while maintaining control over access and changes, ensuring accuracy and compliance.

Conclusion

Effectively verifying the authenticity of public documents is critical in building trust, attracting investors, and meeting regulatory requirements. Countries have specific requirements and systems for annual and ESG reports, backed by laws and regulations to punish false statements. Leveraging AI platforms can provide collaborative capabilities and streamline the verification process, increasing efficiency and reducing common pain points.

Learn more about Factify: https://wizpresso.com/RegulatoryReporting/Factify