Background

Following the release of the Paris Agreement, both Hong Kong and China have set ambitious climate targets to limit the increase of the global average temperature. As set out in Hong Kong’s Climate action plan, the government aims to lower emissions 36% by 2030 and achieve carbon neutrality by 2050. To this end, Hong Kong has continued to expand its sustainable finance products offerings, issuing US$31.3 billion in 2021 (including green bonds and loans), which represented an increasing total amount of green and sustainable debt from 2020. Under the government’s Green and Sustainable Finance Grant Scheme, the private sector has issued HK$150 million through 170 different green and sustainable instruments. Green loans remain an important part of Hong Kong’s multipronged strategy for promoting green finance. Borrowing in green-related debt and financial products has reached an all-time high.

However, the due diligence and assessment process of green financing is highly manual and time-consuming as ESG disclosures become increasingly complex. On average, a relationship or credit manager can take up to three days to prepare a preliminary proposal for a green loan or sustainability-linked loan.

How is the ESG assessment for Green Loan and Sustainability Linked Loans conducted?

The credit and ESG assessment process relies heavily on manual work.

- Consolidating the borrower’s ESG data: Qualitative and quantitative data related to the borrower’s environmental, social, and governance performance over historical years are manually aggregated.

- ESG performance analysis: The borrower’s performance across ESG metrics and factors, such as environmental impact, social initiatives, and governance practices, are analyzed over time and benchmarked.

- Gap analysis and goal setting: Banks work closely with the borrower to identify any ESG gaps and set goals to be achieved as part of the financing requirements.

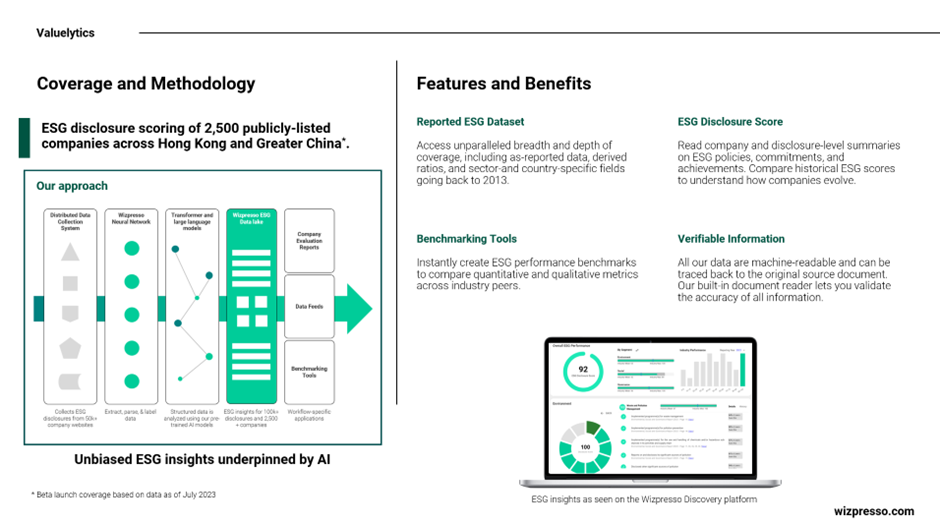

| Wizpresso Valuelytics can automate the generation of an ESG credit summary report – Access unparalleled breadth and depth of coverage, including as-reported data, derived ratios, and sector-specific ESG indicators. – Compare historical ESG scores to understand how borrowers’ ESG initiatives evolve. – Instantly create ESG performance benchmarks to compare quantitative and qualitative metrics across industry peers. – Export ESG summary report for each borrower to streamline the financing approval process |

Conclusion

By leveraging AI technology for ESG disclosure analysis, the credit assessment process for green and sustainability-linked loans can become more efficient, reducing the time required for preliminary proposals. This, in turn, promotes the growth and development of green financing amongst institutions, which supports the government’s climate targets and the transition towards a more sustainable economy.

Learn more about Valuelytics: https://wizpresso.com/MarketIntelligence/Valuelytics