Market Backdrop

In recent years, ESG (environmental, social, and governance) has emerged as an important aspect of corporate governance and responsible business practices globally. The growing emphasis on ESG reflects the recognition that businesses must operate in a socially and environmentally responsible manner to thrive in the long term. Investors are increasingly considering ESG factors in their decision-making processes. Benchmarking allows businesses to communicate their ESG initiatives and performance to investors effectively. By aligning with industry peers and demonstrating continuous improvement, companies can enhance investor confidence and attract responsible investment.

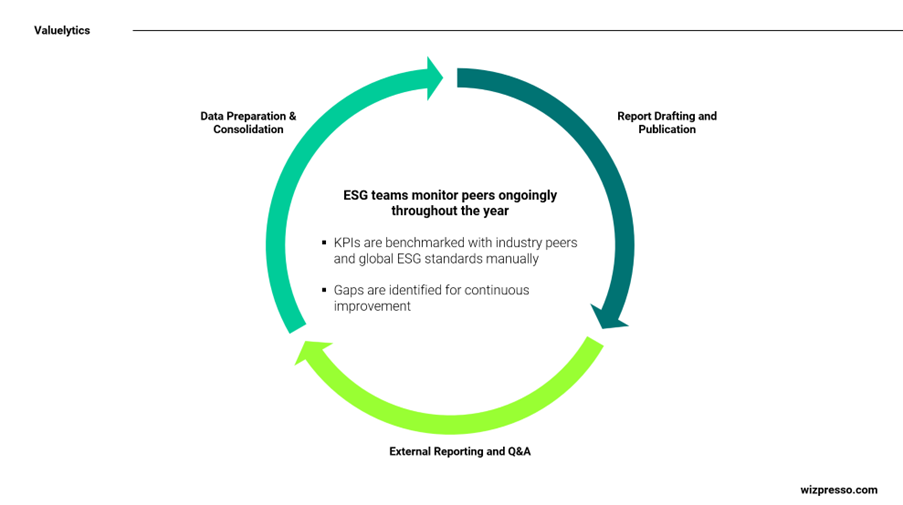

However, companies in Hong Kong often need to rely on manual work and analysis to assess the ESG performance of comparable peers. The lack of standardization in ESG reporting frameworks and metrics makes it challenging to obtain consistent and comparable data for benchmarking purposes. Each company may disclose different sets of ESG indicators, making it difficult to conduct a comprehensive and standardized comparison across peers.

How do issuers benchmark their performance and track peer activities?

- Many issuers may hire consultants or conduct in-house research online to evaluate their ESG performance. First, global and regional peers will be identified for comparison. Depending on the type of ESG standards, issuers will draw up a list of criteria to benchmark against.

- Each peer’s ESG report is meticulously reviewed to identify and capture relevant initiatives, policies, and data that meet the list of criteria to be benchmarked. Issuers may also reference peer websites and third-party data providers for more information.

- Extracted ESG data are compared to identify similarities and gaps in fulfilling specific ESG standards, including SASB, GRI, and Appendix 27.

Wizpresso Valuelytics can radically streamline the way you benchmark performance

1. Our proprietary framework consists of 260+ indicators across 35 themes aligned with global ESG standards and local requirements.

2. Issuers can review company and disclosure-level summaries on ESG policies, commitments, and achievements.

3. ESG analysts can instantly create ESG performance benchmarks to compare quantitative and qualitative metrics across industry peers

4. All data are machine-readable and can be traced back to the original source document

Wizpresso ESG Framework

Conclusion

By adopting generative AI technologies, issuers can overcome the limitations of manual data research and analysis. Issuers can obtain more consistent and comparable data at a low cost, enhance the scope of data coverage, and effectively track ESG performance across the industry. With a sound ESG strategy powered by actionable insights, the issuer can more effectively navigate the ESG landscape, enhance investor confidence, and attract sustainable investment.

Learn more about Valuelytics

product: https://valuelytics.wizpresso.com/